Ian Payne 4am - 7am

11 August 2023, 23:44

Judge Lewis A Kaplan said there was probable cause to believe he had tried to ‘tamper with witnesses at least twice’ since his December arrest.

FTX founder Sam Bankman-Fried left a US federal courtroom in handcuffs when a judge revoked his bail after concluding that the fallen cryptocurrency entrepreneur had repeatedly tried to influence witnesses against him.

Bankman-Fried drooped his head as Judge Lewis A Kaplan explained at length why he believed the California man had repeatedly pushed the boundaries of his 250 million dollar (£197 million) bail package to a point that Judge Kaplan could no longer ensure the protection of the community, including prosecutors’ witnesses, unless the 31-year-old was behind bars.

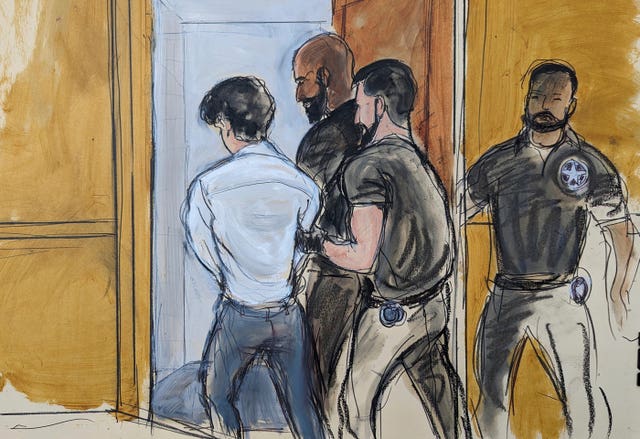

After the hearing ended, Bankman-Fried took off his suit jacket and tie and turned his watch and other personal belongings over to his lawyers.

The clanging of handcuffs could be heard as his hands were cuffed in front of him.

He was then led out of the courtroom by US marshals.

It was a spectacular fall for a man who prosecutors say portrayed himself as “a saviour of the cryptocurrency industry” as he testified before Congress and hired celebrities including Larry David, Tom Brady and Stephen Curry to promote his businesses.

Prosecutors said Bankman-Fried stole billions of dollars in FTX customer deposits to fund his businesses and speculative venture investments, make charitable donations and spend tens of millions of dollars on illegal campaign donations to Democrats and Republicans in an attempt to buy influence over cryptocurrency regulation in Washington.

Judge Kaplan said there was probable cause to believe Bankman-Fried had tried to “tamper with witnesses at least twice” since his December arrest, most recently by showing a journalist the private writings of a former girlfriend and key witness against him and in January when he reached out to FTX’s general counsel with an encrypted communication.

The judge said he concluded there was a probability that Bankman-Fried had tried to influence both anticipated trial witnesses “and quite likely others whose names we don’t even know” to get them to “back off, to have them hedge their co-operation with the government”.

The incarceration order signed by the judge said Judge Kaplan found probable cause to believe Bankman-Fried had committed the federal crime of attempted witness tampering.

Bankman-Fried’s lawyers insisted that their client’s motives were innocent and he should not be jailed for trying to protect his reputation against a barrage of unfavourable news stories.

Lawyer Mark Cohen asked the judge to suspend his incarceration order for an immediate appeal, but Judge Kaplan rejected the request.

Within an hour, defence lawyers had filed a notice of appeal.

Bankman-Fried was sent for the night to the Metropolitan Detention Centre in Brooklyn, which has previously housed convicted “pharma bro” pharmaceutical executive Martin Shkreli and convicted sex offenders R Kelly and Ghislaine Maxwell.

Bankman-Fried had been under house arrest at his parents’ home in Palo Alto, California, since his December extradition from the Bahamas on charges that he defrauded investors in his businesses and illegally diverted millions of dollars’ worth of cryptocurrency from customers using his FTX exchange.

His bail package severely restricted his internet and phone usage.

The judge noted that the strict rules did not stop him from reaching out in January to a top FTX lawyer, saying he “would really love to reconnect and see if there’s a way for us to have a constructive relationship, use each other as resources when possible, or at least vet things with each other”.

At a February hearing, Judge Kaplan said the communication “suggests to me that maybe he has committed or attempted to commit a federal felony while on release”.

On Friday, Judge Kaplan said he was rejecting defence claims that the communication was benign.

Instead, he said, it seems to be an invitation for the FTX general counsel “to get together with Bankman-Fried” so that their recollections “are on the same page”.

Two weeks ago, prosecutors surprised Bankman-Fried’s lawyers by demanding his incarceration, saying he violated those rules by showing The New York Times the private writings of Caroline Ellison, his former girlfriend and the ex-chief executive of Alameda Research, a cryptocurrency trading hedge fund that was one of his businesses.

Prosecutors maintained he was trying to sully her reputation and influence prospective jurors who might be summoned for his October trial by sharing deep thoughts about her job and the romantic relationship she had with Bankman-Fried.

The judge said on Friday that the excerpts of Ellison’s communications that Bankman-Fried had shared with a reporter were the kinds of things that somebody who had been in a relationship with somebody “would be very unlikely to share with anybody, lest The New York Times, except to hurt, discredit, and frighten the subject of the material”.

Ellison pleaded guilty in December to criminal charges carrying a potential penalty of 110 years in prison.

She has agreed to give evidence against Bankman-Fried as part of a deal that could lead to a more lenient sentence.

Bankman-Fried’s lawyers argued he probably failed in a quest to defend his reputation because the article cast Ellison in a sympathetic light.

They also said prosecutors exaggerated the role Bankman-Fried had in the article.

They said prosecutors were trying to get their client locked up by offering evidence consisting of “innuendo, speculation, and scant facts”.

Since prosecutors made their detention request, Judge Kaplan had imposed a gag order barring public comments by people participating in the trial, including Bankman-Fried.

David McCraw, a lawyer for the Times, had written to the judge, noting the First Amendment implications of any blanket gag order, as well as public interest in Ellison and her cryptocurrency trading firm.

Ellison confessed to a central role in a scheme defrauding investors of billions of dollars that went undetected, Mr McCraw said.

“It is not surprising that the public wants to know more about who she is and what she did and that news organisations would seek to provide to the public timely, pertinent, and fairly reported information about her, as the Times did in its story,” Mr McCraw said.