Henry Riley 4am - 7am

3 March 2021, 14:54 | Updated: 3 March 2021, 21:00

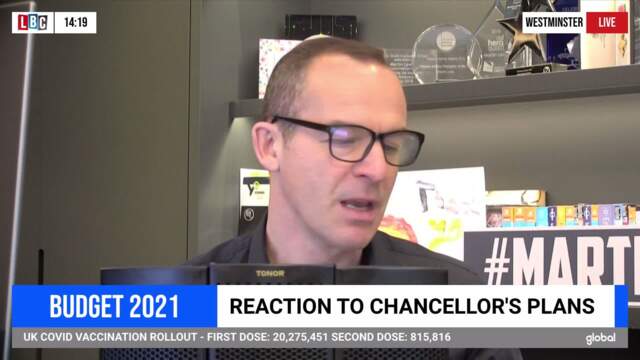

Martin Lewis gives LBC his instant take on the Budget

Martin Lewis, the founder of MoneySavingExpert, gives his instant take on the Chancellor's 2021 Budget.

Chancellor Rishi Sunak has announced his Spring Budget, ranging from extending the furlough scheme to increasing corporation tax.

He introduced a raft of measures to help people and businesses as the Covid pandemic continues to affect the UK economy.

The Chancellor said coronavirus has caused one of the "largest, most comprehensive and sustained economic shocks this country has ever faced".

Watch: Furious 'excluded' caller hits out at Chancellor Rishi Sunak after Budget

Martin Lewis told LBC that "fiscal drag" is the Chancellor's main way of recouping funds in this Budget: "Fiscal drag is where you freeze thresholds so thresholds will go up as planned this year then from next year to 2026, your tax-free allowance, the amount you start paying higher rate tax, capitals gains tax, inheritance tax, lifetime allowances, will all be frozen."

He explained that this will mean that as inflation occurs and wages grow, "more people will pay more tax."

Watch: 'This is the biggest tax-rising budget for nearly 30 years', IFS Director tells LBC

Excluded UK member's instant reaction to Budget

Mr Lewis noted the Chancellor did not cover what will happen to self-employed people on Universal Credit: "There's this rather complicated thing called the minimum income floor and that has been removed at the moment."

He explained that the minimum income floor means, effectively ,that "regardless of what they're actually earning, they'll be assumed to be earning minimum wage at roughly 35 hours a week and their Universal Credit will be counted on that."

"When you get rid of it, there's no assumption of minimum earnings...that has been kept until August."

He explained that from July employers will have to pay 10% towards salary and from August 20%.

For businesses, once they are paying 10-20% of a furloughed person's salary, it's a "crystallisation point to the mind that says I'm only keeping people on who I will definitely need."

Read more: Budget 2021: Key points at a glance

Here are some aspects of the Chancellor's Budget mentioned by Martin Lewis:

Read more: UK's economy to recover more swiftly than previously expected, according to OBR