Shelagh Fogarty 1pm - 4pm

26 September 2022, 10:33 | Updated: 26 September 2022, 10:45

Shadow Chancellor's stark cost of living warning

Shadow Chancellor Rachel Reeves warns the cost of living crisis will be "exacerbated by a weaker pound" accusing the Chancellor and Prime Minister of "gambling" with the public's money.

The conversation comes after the pound plunged to an all-time low against the US dollar amid hammered market confidence in the Government's economic plans after the Chancellor last week unveiled the biggest tax cuts in 50 years and signalled more were on the way.

Speaking to LBC's Nick Ferrari at Breakfast Labour's Shadow Chancellor slammed the mini-budget branding it "concerning."

She said Mr Kwarteng should have used the time to set out a "plan for growth" and a "responsible plan for our finances," but she said neither of those were delivered.

Accusing the Chancellor of having "no plan to get the public finances back on a stable footing," Mrs Reeves said this led to concern in the financial markets.

"It matters because a weaker pound means higher inflation," warning costs of oil and gas would go up.

But, maybe the starkest warning was when the Labour MP predicted a weak pound would be "exacerbated by a weaker pound."

'Bewildered' NHS nurse slams mini-budget saying she'll be poorer

Read more: James O'Brien beyond baffled by mini-budget 'designed entirely to further enrich the richest'

Sterling hit its lowest level against the dollar since decimalisation in 1971, falling by more than 4% to just 1.03 dollars in early Asia trading before it regained some ground to about 1.07 dollars early on Monday.

The euro also hit a fresh 20-year low against the dollar amid recession and energy security fears ahead of what is expected to be a painful winter across Europe as the war in Ukraine shows no sign of ending.

Experts warned the pound's plunge towards parity with the dollar will send the cost of goods soaring even higher, potentially worsening the cost-of-living crisis, while it also means it will be more expensive for the Government to borrow money.

Shadow chancellor Rachel Reeves also accused Chancellor Kwasi Kwarteng and Prime Minister Liz Truss of recklessly gambling with the UK's finances.

Watch: Mick Lynch: 'Repressive' govt declaring 'class war' on working people with mini-budget

Mr Kwarteng has previously brushed off questions about the markets' reaction to his mini-budget - which outlined the biggest programme of tax cuts for 50 years - after it was announced on Friday using more than £70 billion of increased borrowing.

He claimed on Sunday the cuts "favour people right across the income scale" amid accusations they mainly help the rich.

But financial markets continue to be spooked and there are fears the Bank of England may even be forced to step in with an emergency interest rate hike in a bid to steady the pound and rein in inflation fuelled by the tax cuts.

The Bank increased rates by another half percentage point to 2.25% last Thursday, however, financial markets are speculating that it may act with another before its next scheduled meeting in November, which would also impact household mortgage borrowing.

The pound's tumble makes it more expensive to import goods and commodities, such as food, clothes, oil and gas.

It is also seeing the cost of UK borrowing surge higher - last week rising by the most in a single day for at least a decade after the mini-budget as it impacted government bonds.

"There is now a tense stand-off between the Bank of England and the Treasury, with policymakers determined to try to bring down inflation by dampening down demand, while politicians are focused intently on trying to boost demand and promote their growth agenda," said Ms Streeter.

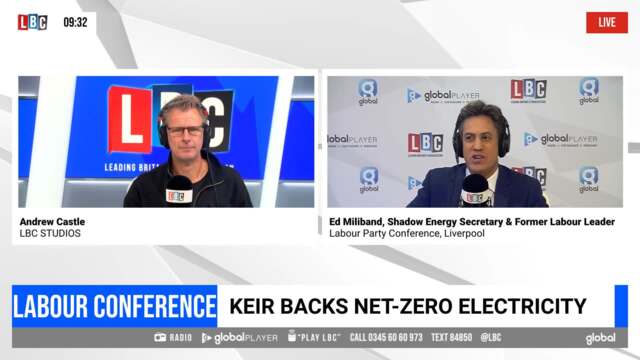

Shadow Climate Secretary Ed Miliband blasts the mini-budget

Mr Kwarteng and Ms Truss have defended their growth plans package, despite analysis suggesting the measures, which include abolishing the top rate of income tax for the highest earners, will see only the incomes of the wealthiest households grow while most people will be worse off.

Three days after his fiscal statement, the Chancellor indicated his announcements were just the beginning of the Government's agenda designed to revive the UK's stagnant economy.

Mr Kwarteng and Ms Truss could continue their spree in the New Year with possible further reductions in income tax and the loosening of immigration rules and other regulations.