Tom Swarbrick 4pm - 7pm

25 August 2020, 08:37 | Updated: 26 August 2020, 09:41

Over the past 24 hours I have been inundated with messages from desperate, angry people trapped in 'unsellable' homes.

They range from residents in high rises, to those who live in short blocks of flats in places like Kent, Birmingham, Manchester, Leeds, Cardiff.

They're young professionals, who want to move out of their first-home one-bed, and start a family.

They're new parents, who, after months of lockdown, now 'really need a garden.'

And they are others, who need to leave their home for a myriad of personal, professional, or financial reasons.

All of them though, have in the last few months, optimistically put their flat on the market and found a buyer, only to be told that their home is now worthless.

The crisis has its roots in the aftermath of the Grenfell Tower fire, and the realisation that thousands of buildings had a similar, dangerous cladding.

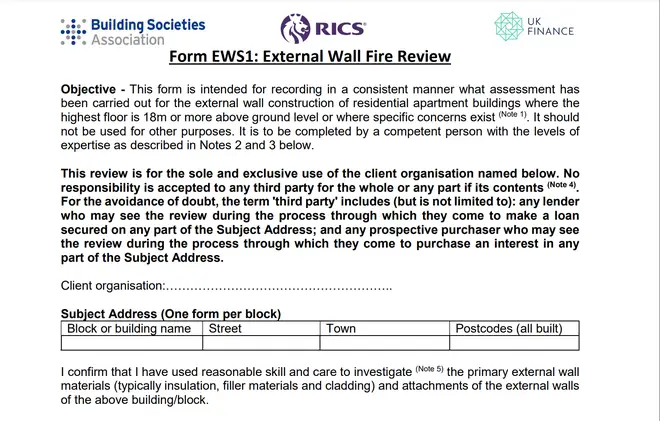

Last winter by the Royal Institution of Chartered Surveyors brought out the EWS 1 form as a way of grading the safety of tower blocks with cladding.

It was meant to be just for buildings with cladding, over 18 metres tall, but at the start of the year Government regulations changed, and now lenders want this form for shorter buildings as well.

It’s thought that could leave around 300,000 buildings that might require an EWS1.

The problem, is that there are only 300 inspectors able to carry out the in depth, intrusive surveys, which has created a massive backlog.

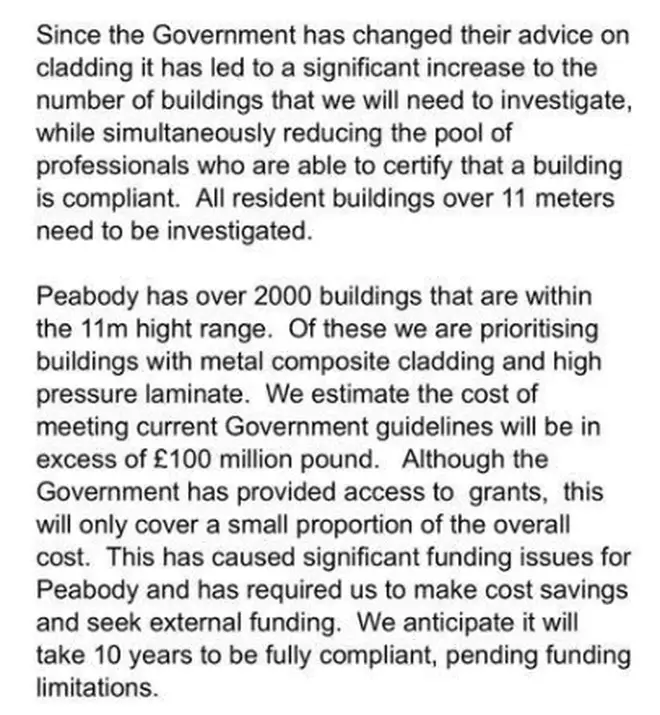

Peabody, is a large Housing Association based in London.

They've written to residents telling them that they think it will be 10 years before they can get all of their buildings compliant.

Other people have written to me, telling me that they are at the 'bottom of the priority list' because they're a lower building, and they think it will be years before their freeholder applies for the test.

It’s thought they cost a minimum of £40,000 per building, and only the freeholder can apply.

Some have already told their residents they won't though - because it's not a legal requirement.

Emma Jones lives in a flat in Walthamstow which she’s been trying to sell for months .

“The cladding is in the process of being removed and it’s due to be fully replaced by the middle of December 2020. However, the building owner has said that as the building is under 18 metres in height and the cladding is being removed that an EWS1 is not necessary and that they will not be conducting this survey.

“They have been unable to provide any other official documentation that will satisfy my buyers lender.

“As a result of this my buyer has just dropped out of the sale and we are at risk of the losing the house that we were hoping to buy, we have now spent thousands of pounds on conveyancing work and surveys as we were totally unaware that there was an issue with selling our flat.

“I am stuck on a high interest rate mortgage (5.3%) and am unable to re-mortgage or sell this property.

“We are trapped.”

London flats "worthless" as they are so unsafe

Sebastian O'Kelly is the chief executive of the charity Leasehold Knowledge - which supports leaseholders:

"We're looking at a perfect storm of disasters descending on the heads of people who own flats.

"And they are largely unsellable now, because mortgage lenders want to know that they are safe, and more sites can't demonstrate that they are safe.

"So you've got 900,000 to one million people living in blocks of flats that are higher than 18 metres which are affected by the cladding crisis."

An MHCLG spokesperson said: “All buildings, regardless of height, should have an up-to-date fire risk assessment which includes the external wall system.

“Building owners are responsible for making sure that their buildings and residents are safe. This includes taking prompt action to resolve any problems identified through fire risk assessments, or other building surveys.

“We recognise the difficulties that some homeowners are facing and we are working with the lenders to support a proportionate approach, exploring other evidence that might assist the valuation process.”