James Hanson 4am - 7am

23 April 2021, 16:05

HMRC Loan Charge: Tax Barrister sets out the details

A top tax barrister has told Nick Ferrari he believes the HMRC are acting "completely against the concept of the rule of law" in attempting to claw back money from self-employed contractors.

Keith Gordon, from Temple Tax Chambers, told Nick "several hundred thousand people" may have been affected by the measure, which is designed to claw back unpaid taxes from people who HMRC says used "disguised remuneration" tax avoidance schemes.

The measures has proved controversial due to the size of sums being demanded by the government as well the length of time since and circumstances in which the schemes were entered into.

Read more: Nick Ferrari challenges Treasury Select Committee Chair on the loan charge

Mr Gordon said he believes HMRC's claim that they are trying to close a tax loophole is "clearly" wrong.

"The loophole that is suggested to have existed is still there, people are still selling these type of schemes, trying to turn taxable salary, taxable wages, into some sort of non-taxable receipts," he explained.

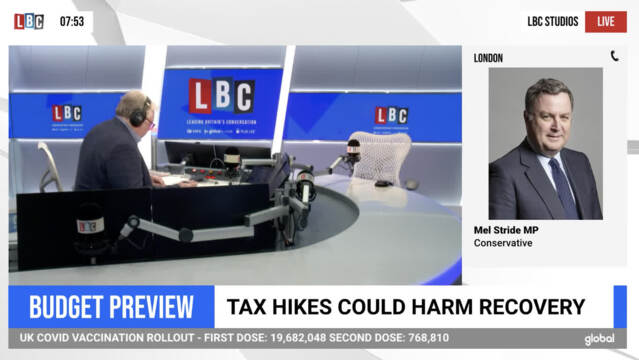

Nick Ferrari challenges Tory MP Mel Stride on the loan charge

"But secondly, the loan charge wasn't actually trying to close this down, it was trying to claw back the tax that HMRC would like to have received on these arrangements in the past but had missed the boat, had failed to take the right steps at the right time against the right people.

"The Revenue were faced with a bit of egg in their face, so what they decided to do was to invent a brand new tax charge so as to replicate the tax that they thought should have been paid at an earlier stage. That is the loan charge."

Loan charge victim tells all to LBC

Asked by Nick why he was so passionate about the issue, the barrister, who has blogged widely on the issue, said it was because the loan charge "works completely against the concept of the rule of law".

Read more: Sir Ed Davey accuses Treasury of 'attacking self-employed people'