Richard Spurr 1am - 4am

1 April 2020, 11:49

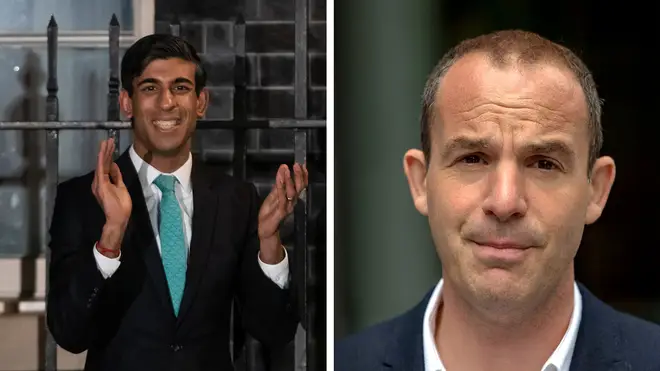

Martin Lewis answers most popular money questions around coronavirus

The UK's leading money expert Martin Lewis answered the most popular money questions about the government's financial response to the coronavirus pandemic.

Chancellor Rishi Sunak has released a host of measures to cover businesses and employees during this period of uncertainty, but it has led to confusion about that is available to people.

Martin spoke to Nick Ferrari to answer the questions he gets answered the most.

"If employers have workers who don't have work to do, they can put them on furlough, which is like putting them on standby, then the government will pay 80% of their salary up to £2,500 per month. The employer doesn't have to add on to that, although it can if it wants to.

"The state will also give the employer the National Insurance contributions and the minimum pension contributions on top, so there is zero cost to the employer.

"My big issue with this is that many employers are not putting staff on furlough, they are making them redundant or giving them unpaid leave because they may think furlough is cheating the system. That's the wrong way around.

Here is a list of things you are allowed to furlough for:

- Staff who have no work

- Staff who can't work because they need 12-weeks self-isolation

- Staff who can't work because they must be home for the kids

- Staff with variable incomes, zero-hours contracts or agency workers

And most importantly, you can re-hire staff who were on your payroll on 28th February - even if they left voluntarily, you can bring them back and furlough them.

My recommendation to employers: if you can furlough, furlough.

This is for people who are sole-employee limited company directors, who pay themselves a small salary by PAYE and top that up with dividends. There is no support for dividends.

The only option you have if you are not working is to furlough yourself as an employee - which is allowed. While this means you wouldn't be allowed to work, I've had confirmation that you are still allowed to complete your statutory obligations as a company director, such as filings.

For the rest of it, there is Universal Credit. People poo-poo Universal Credit, but in the right situations, where the rents are high, the housing payment has been unfrozen, £1,000 per year has been added to it, the minimum income floor for the self-employed has been got rid of. So in certain circumstances, that means people might get £1,000 - £1,500 per month tax-free if they qualify in the right way.

Furloughing yourself and claiming Universal Credit are the only things available.

If you do this right, it won't affect your credit rating, but it will if you do it wrong.

A mortgage payment holiday is where your mortgage provider says to you you do not need to pay your mortgage. Currently, they are doing it for three months. Most of the major lenders, you can apply online for this and it can take as little as five minutes.

What this means is that you don't pay for three months. The interest does still tick up and you have to pay it back afterwards.

But let's put that in context. Take someone with 20 years left on the mortgage who's paying £700 per month now. If they take a three-month mortgage holiday, for the remaining 19 years and nine months, instead of paying £700 a month, they'll pay £712 per month. So a moderate increase to get the cash flow benefit now, which for many people is needed to keep their head above water.

The big problem is some people are trying to give themselves a mortgage holiday by simply cancelling their mortgage direct debits. That is a big mistake, that will hit your credit rating. You mustn't do it.

A mortgage holiday has to be approved by the lender. Once it is, that holiday will not affect your credit score.

In the stuff that Rishi Sunak has done, it has been revolutionary and radical. They have re-written decades-old policies in days, which has been quite extraordinary.

The real test will come over the next couple of weeks when we see the holes in this system - employers not playing ball on furloughing, the self-employed who are struggling, the people who set up businesses since April 2019. How will they fix those gaps?

I'm going to give an A- so far for the rapidness of bringing in these new systems, but that will de-grade if over the next couple of months, we don't start to see some finesse and nuance on what was put in place to cover holes.