Nick Abbot 10pm - 1am

30 November 2020, 11:12 | Updated: 30 November 2020, 12:30

The UK government has announced their third grant to help those who are self employed during the coronavirus pandemic - here’s how to apply for the grant and if you’re eligible.

The coronavirus pandemic has brought along some of the highest unemployment rates in the UK which led the British government to introduce a furlough scheme and now, their third grant for those who are self-employed.

Launched on November 30, those who work for themselves could be entitled to up to £7,500 if their income has been severely impacted by Covid-19.

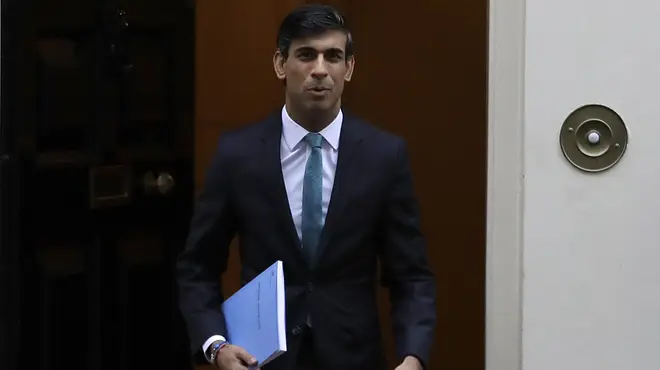

Rishi Sunak announces furlough scheme extended until the end of March

So who is eligible for the third government self employment grant? And how do you apply for the grant? Here’s what you need to know:

Rishi Sunak announced the scheme as a way to help the self-employed the way furlough is helping those who have been temporarily out of work because of coronavirus.

Officially named the self-employment income support scheme (SEISS), the grant helps those who have had their income severely reduced - November is the third round of grants. It will cover trading profits from November 2020 to January 2021.

To be entitle to the government grant, there’s a range of criteria you need to have. This includes you being eligible for the first and second grant (even if you didn’t apply) and you must declare that you intend to carry on trade, but your work demand has changed due to Covid.

If you’re not able to continue to trade because of the pandemic you must declare that you were previously trading and that coronavirus is the reason you can’t work.

You must also earn more than half of your total income from self-employment and trading profit must be lower than £50,000 a year. Your grants are then calculated based on your average profits over three tax years.

Head to gov.uk for a full checklist.

The claim is made via the gov.uk website where self-employed workers will need a number of things to put the claim through.

This includes your unique taxpayer reference (UTR), your National Insurance number, bank details and your Government Gateway user log in details.