Jim Diamond 1am - 4am

14 August 2023, 07:07

David Buik is LBC's Markets Commentator and a Consultant to Aquis Exchange

There is little doubt that the regional banking crisis in the US three months ago, triggered by the SVB debacle, followed up by the demise of Credit Suisse put ‘the cat amongst the proverbial pigeons’ for the global banking sector, rattling a few governments and shareholders’ feathers along the way!

Calm had hardly been restored, before Labour was making ill-considered demands for a windfall tax from a sector that simply cannot afford it, if the levels of capital and liquidity are to be maintained indefinitely. I admit the UK banks are not helping themselves, by not passing on rate increases to depositors unless they are bullied.’ Italy is now also giving serious consideration to demanding a similar tax on their banks.

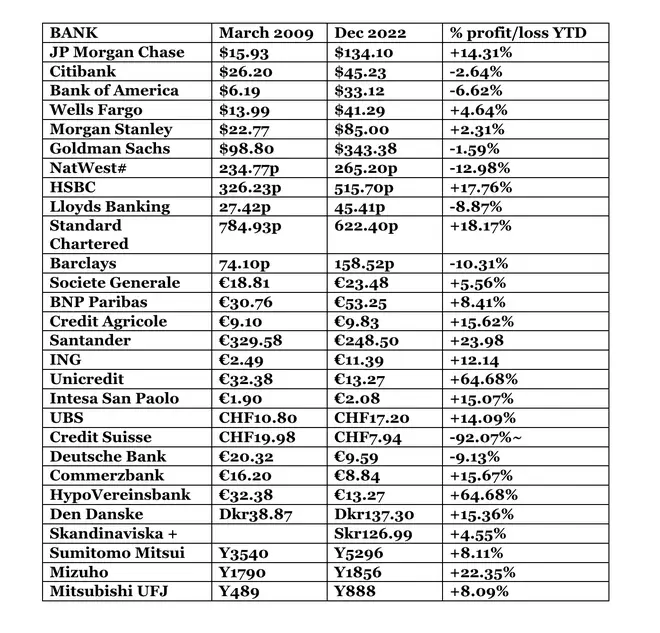

As can be seen from the tables above, though many European banks have performed well year to date, the banks, as a whole have proved to be a poor sector to invest in since 2008, especially if the performance is measured from 2007, when the sector was at its zenith, before the credit crisis mutilated its share prices. The only exceptions to the rule have been some US banks especially JP Morgan Chase, and Canadian and Australasian operators, which did not get sucked in to ‘sub-prime’ lending or reckless lending to property.

It is now almost fifteen years since the start of the global banking/credit crisis of 2008/9, which was triggered by the ‘sub-prime’ banking crisis in the US. The banking crisis savaged many regional banks in the US, aided and abetted by Freddie Mac, Fannie Mae and Ginnie Mae, the official secondary mortgage government backed facilitator. Ironically the denouement of this catastrophic financial crisis was originally flagged up by HSBC in 2007, post its purchase of ‘Household’ for $14.8 billion in 2003.

The US, thanks to initiatives from Treasury Secretary Tim Geithner and FED Chairman Ben Bernanke, such as the introduction of TARP, a facility all major banks, including the likes of Goldman Sachs were forced to avail themselves of on a temporary basis, triggered the recovery of the banking sector rather more quickly than banks in the UK and Europe did.

There was, of course a cost. 465 regional banks ‘went to the wall.’ U.S. employers shed 2.6 million jobs in 2008, the worst year since 1945, with the unemployment rate jumping to 7.2 percent in December, the highest since January 1993. Thousands lost their homes, with many losing a fortune in the process.

Initially, to combat the crisis, the Fed announced an aggressive assistance programme to deal with the financial crisis of 2008. It began buying $500 billion in mortgage-backed securities and $100 billion in other debt. Then between March 2009 and March 2010, the Fed purchased $200 billion in agency debt (debt from Fannie Mae, Freddie Mac, and Ginnie Mae) and $1.25 trillion in mortgage-backed securities and $300 billion in long-term Treasury debt. This help was a prerequisite.

The UK Government’s and Bank of England’s response to the crisis was also incisive. Quantitative easing reached £425 billion by the end of 2009. The EU/ECB seemed rather more ponderous in officially reacting to the crisis. They called it methodical. Apart from dealing with immediate liquidity issues on an ad hoc basis, QE was not introduced with a vengeance until 2014, when a facility of €3.3 trillion for the ECB to buy in bonds was made available. As we all know to our cost is that quantitative easing has exacerbated today’s global rate of inflation. However, at the time, its introduction with indecent haste was essential.

In March 2008, US Treasury Secretary Hank Paulson persuaded JP Morgan’s Jamie Dimon to scoop up Bear Stearns for $2 a share, less than a tenth of its value at the time and Wall Street’s number one bank also tucked away Washington Mutual to prevent another financial embarrassment. Bank of America bought out Merrill Lynch, considered to be an investment bank with an impeccable record. However, Paulson called ‘time out’ on Lehman Brothers. At its peak, Lehman was valued at nearly $46 billion, which was wiped out in the months leading up to its bankruptcy. Pulling the plug on Lehman imploded catastrophic damage on the global derivative market, with many banks suffering far greater losses than was necessary.

David Buik & Michael Wilson, two of the most respected commentators in the world of Money and Business come together for a weekly Global Player original podcast – Money!

The inability to ‘cross-check’ deals on the exchanges, thanks to Paulson’s and the US Government’s decision, magnified the financial damage inflicted. Deutsche Bank, at that time, was almost certainly the largest derivative trader in the world, suffered more than most and has needed endless nursing in its recovery process. At its height Deutsche Bank’s share price hit €93. Today, after copious rights issues, it stands at €9.94! UBS, considered to be Europe’s leading bank also suffered from the credit crisis. The world's largest asset manager, found itself without liquidity and a mountain of illiquid securities, having already wiped $40 billion of assets in the subprime crisis.

As for the UK, the demise of its banking sector had little to do with ‘sub-prime’, apart from Northern Rock Building Society and Bradford & Bingley – much more to do with injudicious lending on poor credit analysis. The Government embarked on a soft regulation programme, which the Conservative opposition supported. Balance sheets reached gargantuan proportions, despite warnings from Lord Mervyn King and Sir Paul Tucker. The crash in response to what was happening in the US and Europe was inevitable. The subsequent bailout cost to the UK taxpayer was at least £75 billion.

Lloyds Bank is rumoured to have had its arm twisted by Gordon Brown to buy Bank of Scotland. Regulation in the UK became as tight as a drum. Banks were required to raise ten times the amount of capital to execute the same business. Investment banking became almost an extinct species, apart from business conducted by HSBC – most of it overseas and by Barclays, who bought the remnants of Lehman’s core business for $1.5 billion, which mainly consisted of its bond issuances and trading operation. This was an extremely shrewd piece of judgement by Bob Diamond.

What of Canada and Australasia? Canada avoided subprime. David Lodge was Governor of the Bank of Canada, and he made sure that Canadian bank balance sheets were relatively clean. Mark Carney – soon to be appointed Governor at the Bank of England maintained Lodge’s policies. It paid huge dividends. The same approach was adopted by Australasian banks, as can be seen from the table above. Japan at the time was re-grouping domestically, cutting back their activities in Europe and the US. So, Japanese banks, many of them having merged, came out of the crisis relatively unscathed.

The toxic nature of the banking crisis led to a loss of more than $2 trillion from the global economy. U.S. home mortgage debt relative to GDP increased from an average of 46% during the 1990s to 73% during 2008, reaching $10.5 trillion. Though the US’S economy has shown a level of robustness in terms of its recovery process, the same cannot be said of the UK and Europe, where growth remains very sluggish. Clearly the pandemic has not helped. Nonetheless the damage inflicted by a globally under-regulated sector means that full recovery remains a dream for the future.