Nick Abbot 10pm - 1am

18 October 2022, 19:42

The UK's abortive economic policies introduced and reversed over the past month have been a warning to other countries 'not to defy economic and financial logic', a top economist has said.

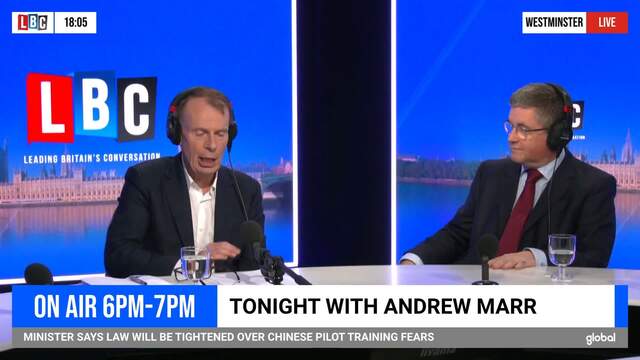

Speaking on Tonight with Andrew Marr, Mohamed A. El-Erian, chief economic advisor at insurance and investment firm Allianz, said that Liz Truss' mini Budget, the market turmoil that ensued and the u-turns that followed were all a salutary lesson to other governments thinking about following suit.

Mr El-Erian said: "There are some people who think that's the greatest thing that could have happened because it's a warning to other countries, not to try to defy economic and financial logic."

Chief Economic Advisor at Allianz, Mohammed A. El-Erian

Beleaguered Prime Minister Ms Truss is trying to battle on after a disastrous start to life at Downing Street, having been elected only on September 5.

She had to tear up her economic policies of hefty tax breaks after markets were spooked by whether the government could afford them, then sacked Kwasi Kwarteng as chancellor just days into his job.

Ms Truss replaced Mr Kwarteng with Jeremy Hunt, a former supporter of Ms Truss' leadership rival Rishi Sunak, who then killed off most of the rest of the economic plan on Monday, leaving questions over whether he was more in charge than she was, and Tories reportedly plotting to oust her.

And Mr El-Erian said he thought the back-and-forth of the past few weeks had made the UK seem more like a developing economy, rather than one of the largest in the world.

He said: "I was at the annual meetings of the IMF and the World Bank, and everybody was talking about the UK.

"Lots of people saying that with an IMF reprimand, a negative watch from a rating agency, currency collapsing, yields going up, emergency intervention by a central bank, government U-turns all that look more like a struggling developing country than a G7 economy."

Mr El-Erian said that this risk and uncertainty meant that investors were adding a "premium" to British debt.

"We've introduced something that's not typical of a serious, G7 country and that's political risk," he said.

Andrew Marr challenges Robert Buckland on his support for Liz Truss

"The notion that the continuity of policy is in doubt - that's something relatively new, and it will take time and effort to reduce that premium."

One of the major knock-on effects of Ms Truss' mini-Budget and its effect on financial markets has been the Bank of England hiking interest rates, leading to many mortgage holders having to pay back more each month.

Mr El-Erian said that the damage would last for "at least" the next half a year.

"They are doomed for at least the next six months," he said. "It takes time... and effort to try to restore what we had before.

"So yes, mortgages are going to be more expensive, companies are going to pay more on that debt that they need to expand production."

Asked if the damage to the economy was permanent, Mr El-Erian added that "most" was "repairable" - but not all.

He said: "There's going to be significant long-lasting damage. Think of it as scarring, you can fix most of it, but you can't fix it all."