Henry Riley 4am - 7am

23 March 2022, 13:58 | Updated: 23 March 2022, 18:00

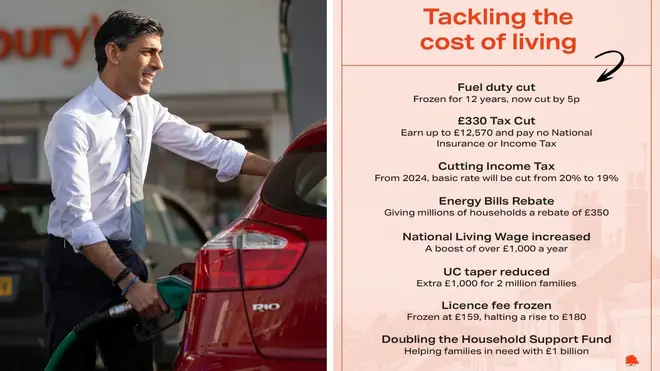

Brits are set to face the highest tax burden since the 1940s despite Chancellor Rishi Sunak raising the national insurance threshold, cutting income tax and slashing fuel duty tax by 5p.

Mr Sunak delivered his Spring Statement to the House of Commons on Wednesday in an attempt to ease the burden of the cost of living crisis on families.

In his statement, he announced that he is increasing the rate at which workers start paying National Insurance to £12,570 - bringing the threshold in line with Income Tax from July this year.

The Chancellor, who recognised the impact of Russia's invasion of Ukraine, also confirmed he is cutting fuel duty by 5p for a year.

Ring Rishi: Join Iain Dale from 7pm this evening for an exclusive phone-in with the Chancellor. You can watch it LIVE on Global Player.

He told MPs that the basic rate of income tax will also be cut from 20p to 19p in the pound by the end of this Parliament - 2024.

Read more: Cuts to fuel, tax and VAT: Spring statement key points at a glance

Read more: What is fuel duty and what difference will a 5p cut make to costs?

Sunak: 'It’s a £6bn personal tax cut for 30 million people in the UK'

He said this equates to a £5bn tax cut for 30 million people.

Mr Sunak said he wanted people to know the Government will "stand by them" in dealing with rising living costs, telling MPs: "Today I can announce that for only the second time in 20 years, fuel duty will be cut.

"Not by one, not even by two, but by 5p per litre. The biggest cut to all fuel duty rates - ever."

But the Office for Budget Responsibility (OBR) said the amount of tax paid compared to GDP, or gross domestic product, will hit the "highest level since the late 1940s" in the following years.

It says net tax rises plus the "more tax-rich composition" of forecasted economic activity raises the tax burden from 33% of GDP in 2019/20 to 36.3% in 2026/27.

Its fiscal outlook says this is the "highest level since the late 1940s", adding that this "is a 3.3% of GDP increase in the tax burden in the space of seven years".

Read more: What is fuel duty and what difference will a 5p cut make to costs?

Read more: Food bank users 'reject potatoes' because they can't pay to boil them, says Iceland boss

Single mother reacts to Rishi Sunak's Spring Statement

Critics have claimed the measures introduced by the Chancellor don't go far enough and say his decisions are making the cost of living crisis worse.

Shadow chancellor Rachel Reeves told the Commons: "Today was the day that the Chancellor could have put a windfall tax on oil and gas companies to provide real help to families, but he didn't.

"Today was the day the Chancellor could have set out a proper plan to support businesses and create good jobs. But he didn't.

Read more: Martin Lewis: Rishi's Spring Statement 'peanuts compared to cost of living crisis'

Analyst reflects on Rishi Sunak's Spring Statement

"Today was the day he could have properly scrapped his national insurance hike, he didn't.

"We said it was the wrong tax at the wrong time, the wrong choice. Today, the Chancellor has finally admitted he got that one wrong.

"Inflation is at its highest level for 30 years and rising. Energy prices at record highs. People are worried sick.

"For all his words, it is clear that the Chancellor does not understand the scale of the challenge. He talks about providing security for working families, but his choices are making the cost-of-living crisis worse, not better."

Chorley chippy manager fears for the future despite Spring Statement

The Lib Dems have also accused the Chancellor of adding to families' pain.

Its Treasury spokeswoman said: "Families were looking to the chancellor to offer them hope, instead he is adding to their pain by refusing to scrap his unfair tax rises.

"People seeing the biggest plunge in living standards in 50 years will see through the chancellor's spin.

"Rishi Sunak has failed to introduce a windfall tax on the super profits of oil and gas producers, which could have raised billions to help people with their energy bills.

"And he has refused to bring in an emergency cut to VAT, as Liberal Democrats have called for, which would put £600 back into the pockets of the average family."

The Chancellor had been under pressure to scrap the health and social care levy, but Mr Sunak insisted the levy will stay.

He told MPs: "A long-term funding solution for the NHS and social care is not incompatible with reducing taxes on working families."

Rishi Sunak cuts fuel duty by 5p

Paul Johnson, director of the Institute for Fiscal Studies (IFS), said the £3,000 increase to the national insurance threshold would "more than compensate about 70% of workers".

Posting on Twitter, he voiced doubts the 5p off fuel duty would be in place for a year only, adding: "It hasn't managed to increase even in line with inflation for more than a decade."

"And 5p not huge in context of prices up 20p+ per litre," he tweeted.

Mr Johnson said it was "unsurprising" growth forecasts have been downgraded and that an average inflation of 7% implies it could peak at "around 9%".

In another tweet, he added: "If £0.5bn is all there is for poorest families paid through local authorities, that will be hugely disappointing.

"Doesn't look like benefits being raised."

Meanwhile, money saving expert Martin Lewis said the tax cut is "still peanuts compared to the cost of living crisis".

He told LBC's Andrew Castle the announcement was better than he expected, but worse than he wanted.