Tonight with Andrew Marr 6pm - 7pm

23 October 2020, 08:32

"£2bn in furlough fraud, how did that happen?"

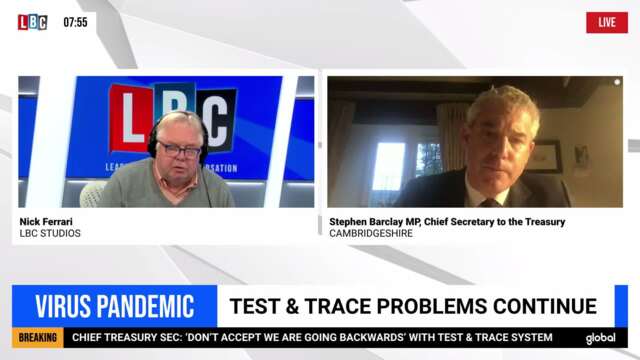

Chief Secretary to the Treasury Stephen Barclay has told LBC that 'arrests have already been made' after it was revealed that fraudsters have raked in two billion pounds through furlough fraud.

Speaking to Nick Ferrari at breakfast, Chief Secretary to the Treasury Stephen Barclay was asked: "Two billion pounds of furlough fraud, how did that happen?"

"Because of this balance between speed and trying to cover as many people as possible," Mr Barclay responded.

"There is a balance to strike between recognising that many businesses had cash flow pressures and many people needed very quick support."

Read more: Tougher Covid-19 restrictions begin for millions of people across England and Wales

Read more: Boris Johnson admits 'frustrations' over Test and Trace after LBC question

A new report has found that two billion pounds was stolen from people cheating the furlough system, put in place by the government to alleviate the strain on struggling businesses during the pandemic.

Almost one in 10 of those put on furlough admitted working during lockdown in breach of the regulations at their employer’s request, the National Audit Office found report found.

The NAO report said that the speed with which the schemes were designed and implemented in the first weeks of the coronavirus crisis in March meant there was “a risk of considerable levels of fraud and error, particularly for the furlough scheme”.

Mr Barclay continued: "We wanted to do that with existing mechanisms but then that leaves us open to the charge of letting some people fall through the cracks and some people being excluded from that.

"It's getting the balance right. Where people have abused the schemes we have we are taking action and arrests have already been made in respect to the furlough scheme.

"So we are taking action but it's about getting that balance between speed of money out to those businesses that need it, but also trying to cover as many people as possible while recognising we can't cover everyone."

Read more: Covid crisis to cost London £11bn of tourist cash, Sadiq Khan warns

Read more: Oxford Covid vaccine 'working as expected' and 'provokes strong immunity'

Some 9.6 million workers were receiving furlough payments at the scheme’s peak in May, while the self-employed income support scheme (SEISS) made payments to at least 2.6 million. Together, the initiatives are predicted to have cost £70bn by the time the JRS closes at the end of next week.

The true scale of money lost to fraud and error will not be known until the end of 2021, but HM Revenue and Customs estimates released last month suggest that it could reach as much as £3.9bn for Mr Sunak’s job retention scheme (JRS), with further losses relating to a separate scheme for the self-employed.

The NAO said the schemes were “largely successful in protecting jobs”, with as much as 30 per cent of the entire UK workforce receiving JRS support in May and 77 per cent of the self-employed taking SEISS payments.

But the watchdog said there was “considerable risk that some employers committed furlough fraud by keeping employees working in lockdown, against the rules of the scheme, or by claiming payments and not passing them on to employees in full”.

"I'm absolutely livid, I've had no money, no help since March."

Nick then pushed the Minister on this, asking: "What is the emotion you feel when you see the headline 'two billion pounds nicked'. How do you react?"

"My reaction is to ensure that wee then take enforcement and action, go after those people and prosecute them," he responded.

A fraud hotline set up by HMRC has received more than 10,000 calls, many referring to cases where employees worked despite their employer claiming for them as furloughed staff.

Nick pushed him further, stating that this means ten per cent of all money given out by the scheme was stolen, and asked for his reaction on this.

Mr Barclay stated: "You can't have it both ways and on one hand say we need to take our time and have better controls on our schemes to ensure there is a lower risk of abuse and at the same time say that we should be quicker and cover more people, even those we don't have information on.

"So the speed permits that amount of thieving?" Nick questioned.

"It's not about permitting, HMRC is taking action to go after those areas of abuse and we will prosecute where that arises."

A Government spokesperson said: "The Government's priority from the start of the outbreak has been on protecting jobs and getting support to those who need it as quickly as possible, and our employment support schemes have provided a lifeline to millions of hardworking families across the UK. We make no apology for the speed at which they were delivered.

"Our schemes were designed to minimise fraud from the outset and we have rejected or blocked thousands of fraudulent claims. We will not tolerate those who seek to defraud taxpayers and will take action against perpetrators, including criminal prosecution."