Rachel Johnson 7pm - 10pm

26 May 2023, 23:27 | Updated: 27 May 2023, 08:34

Rishi Sunak is being warned that Britain still could face a recession next year - as he celebrates better than expected economic growth.

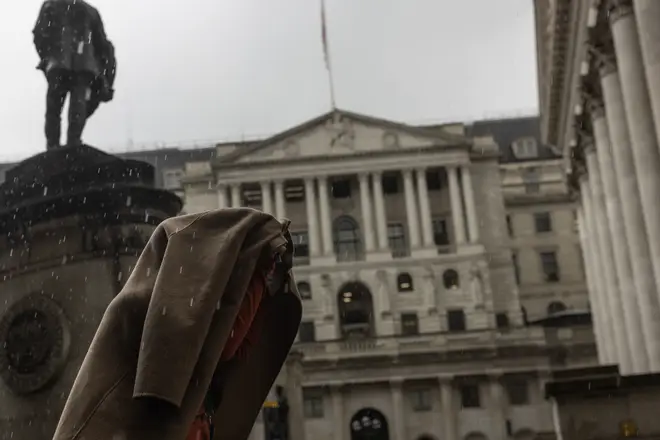

Jagjit Chadha, the director of the National Institute of Economic and Social Research, said that the UK was "in danger of engineering a recession" if interest rates continue to rise to take inflation.

Brits are being slapped with a double whammy of 5% interest rates and limited spending power due to sky-high inflation.

Chancellor Jeremy Hunt has been roundly criticised for asserting that he wants interest rates to rise regardless of whether it tips the UK into recession or not.

The Office for National Statistics (ONS) said the decrease was mainly driven by gas and electricity costs remaining stable in April. It is the first time the CPI has been below 10 per cent in eight months.

Read More: Rocketing food prices see UK inflation fall less than hoped

Read More: UK retail sales rebound in April despite inflation pressure

However, food prices are still surging at 19.1%, according to today’s data.

Chancellor of the Exchequer Jeremy Hunt said: “The IMF said yesterday we've acted decisively to tackle inflation but although it is positive that it is now in single digits, food prices are still rising too fast.

"So as well as helping families with around £3,000 of cost of living support this year and last, we must stick resolutely to the plan to get inflation down.”

“The economy has performed better than expected so far in 2023, but if this means that inflation is going to be sticky and the Bank still has to go further to combat inflation, the economic pain is going to be badly timed for the government.”

Shadow chancellor Rachel Reeves said: "As bills keep surging, families will be worried food prices and the cost of other essentials are still increasing.

Financial markets now fear when the Bank of England evaluate interest rates that they could heap misery onto borrowers and provide no relief from rising prices.