Ian Payne 4am - 7am

27 February 2021, 07:09

Britain's public finances will face "enormous strains" in the wake of the third national lockdown, the Chancellor has warned.

Ahead of Wednesday's Budget announcement, Chancellor Rishi Sunak told the Financial Times a bill for the Government's £280bn investment in coronavirus support will eventually have to be paid, with low interest rates leaving the nation's finances "exposed".

Mr Sunak said: "We now have far more debt than we used to and because interest rates ... at least a month or two ago were exceptionally low, that means we remain exposed to changes in those rates.

"That's why I talk about levelling with people about the public finances [challenges] and our plans to address them."

While Mr Sunak did not reveal any details on specific tax measures, the Budget is expected to include a swathe of actions aimed at kickstarting the nation's economy as lockdown eases over the coming months.

These include a £126 million boost for traineeships and a mortgage guarantee scheme aimed at helping aspiring homeowners with small deposits onto the property ladder.

Mr Sunak added that while there is a challenge facing the nation's economy, he believes the Budget will be a much-needed boon for those hit hardest by the pandemic.

He said: "I stood up at the beginning of this [coronavirus] thing and said I will do whatever it takes to protect the British people through this crisis and I remain committed to that.

"We went big, we went early, but there is more to come and there will be more to come in the Budget. But there is a challenge [in the public finances] and I want to level with people about the challenge.

"Some 750,000 people have lost their jobs and I want to make sure we provide those people with hope and opportunity. Next week's Budget will do that."

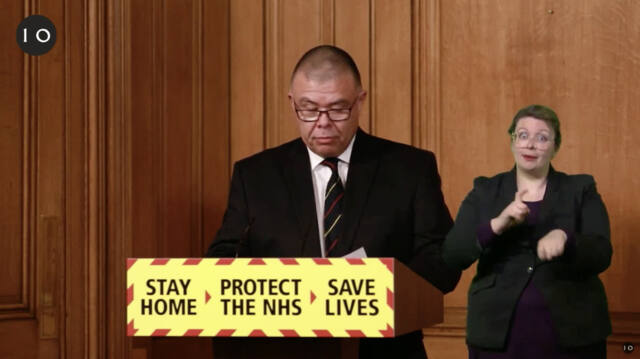

Read more: 'Do not wreck this now', Van-Tam warns as some areas see rising Covid cases

Read more: Military should step up ‘more often’ in UK crisis response, General Sir Nick Carter tells LBC

"Do not wreck this now," warns Professor Jonathan Van-Tam

One of the first things announced by the Chancellor is a mortgage guarantee scheme aimed at helping aspiring homeowners with small deposits onto the property ladder and firing up the market will feature in next week's Budget.

Rishi Sunak plans to incentivise lenders to provide mortgages to first time buyers, and current homeowners, with just 5 per cent deposits to buy properties worth up to £600,000.

He will detail on Wednesday how the Government will offer lenders the guarantee they require to provide mortgages covering the remaining 95%.

The Treasury said low-deposit mortgages have "virtually disappeared" because of the economic impacts of the coronavirus pandemic.

Prime Minister Boris Johnson said: "I want generation rent to become generation buy and these 95% mortgage guarantees help to deliver this promise.

"Young people shouldn't feel excluded from the chance of owning their own home and now it will be easier than ever to get onto the property ladder."

The scheme, which will be subject to the usual affordability checks, will be available to lenders from April.

It is based on the Help to Buy mortgage guarantee scheme introduced in 2013 by David Cameron and George Osborne, that ran until June 2017.

Aiming to reinvigorate the market following the 2008 financial crisis, that scheme was said to have helped more than 100,000 households buy a home across the UK.

Mr Sunak said: "Owning a home is a dream for millions across the UK and we want to help as many people as possible. Saving up for a big deposit can often be difficult, and the pandemic has meant there are fewer low deposit mortgages available."