Ben Kentish 10pm - 1am

27 March 2022, 18:55 | Updated: 28 March 2022, 05:19

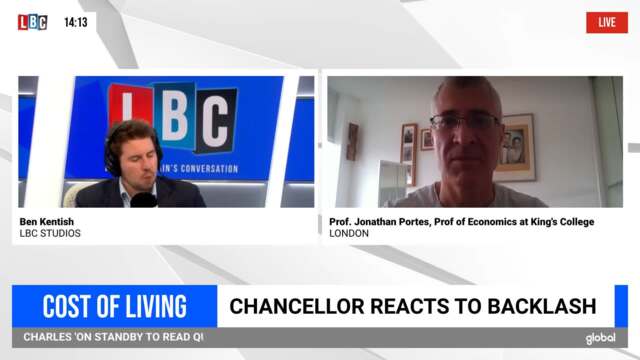

Chancellor Rishi Sunak is 'considering a second council tax rebate' following the backlash over his Spring Statement, with Labour branding him 'Mr Tax'.

The move is intended to help ease the impact of soaring fuel bills, according to the Sunday Times, amid Tory pressure for further action.

A Treasury insider told the paper: "We've already looked at this and concluded that council tax is the best way to do it. You’ve got an existing mechanism.

"You don't need to set up a whole new system. It would make sense to do it like that again."

A package of support already announced included a £200 up-front rebate on energy bills from October, which will have to be repaid over five years from 2023, plus a £150 council tax rebate for homes in bands A to D from next month.

It comes as Shadow Work and Pensions Secretary Jon Ashworth nicknamed the Chancellor "Mr Tax" after accusing him of imposing the biggest cut to state pensions in half a century.

He warned that pensioners had been "cutting back on hot meals" and "forgoing hot showers" as they could not afford the cost.

Mr Ashworth also criticised Mr Sunak over the Spring Statement he delivered last week, in which he announced a '£6bn tax cut' and slashes to fuel duty.

He said he had "room for manoeuvre" in his mini budget but instead acted "in his own interest" rather than those of Brits.

Read more: Cost of living crisis: Inflation rises by 6.2% and its highest level in 30 years

Read more: Sunak unveils '£6bn tax cut' and slashes fuel duty in Spring Statement

Camilla clashes with caller on people spending during energy crisis

Mr Ashworth told Sky News: "Rishi Sunak absolutely had more room for manoeuvre in this Spring Statement and mini budget, but rather than acting in the interests of the British people, he was playing games.

"He was acting in his own interest because he thinks by offering an income tax cut in two years that'll help him politically with Conservative MPs if there's a leadership contest or that'll fit the Tory election grid.

"I don't believe that putting 1.3 million people into poverty because you're imposing a very severe real-terms cut to Universal Credit, you're imposing the biggest cut to the pension in 50 years, is fair."

Labour analysis suggested the Government's decision to downgrade the pension triple lock - which guaranteed the basic state pension would rise annually by either a minimum of 2.5 per cent, the rate of inflation, or average earnings growth - would result in a £427 hit in 2022.

Read more: Sunak mocked for filling 'Sainsbury's worker's' Kia and struggling with contactless card

The Government is set to uprate benefits by 3.1 per cent in April. However, the inflation rate is expected to average nearly 8 per cent over the year.

Mr Ashworth said Mr Sunak should have imposed a "windfall tax" on the profits of oil and gas companies to generate funds to help struggling families and pensioners with energy bills.

"He chose not to do that," he said.

"Instead, he's imposed these very punishing tax rises, these very severe real-terms cuts to the pension and support like universal credit, and he's expecting people to be grateful because two years down the road he's saying there's going to be an income tax cut even though that income tax cut nowhere near offsets the 15 tax rises that he has imposed on the British people, £3,000 extra per household if you do a rough and ready calculation.

"He is a tax-rising Chancellor, he is Mr Tax and it's the British people who are paying the price."

Treasury minister Simon Clarke told MPs high inflation "will be reflected" in the benefits uprating figures for April 2023, which will be calculated in September.

But Mr Ashworth suggested the Government should have brought forward some of the increases rather than wait until 2023.

A Treasury spokesperson said: "The pandemic caused the biggest economic shock in over 300 years and we answered with an exceptional response to support lives and livelihoods across the UK.

"As a result, levels of borrowing rose to levels not seen since the Second World War so we have had to make tough decisions to repair the public finances – as well investing billions in tackling the NHS backlog, reforming social care, and continuing the fight against covid.

"Despite this, the Tax Plan announced at Spring Statement delivers the biggest cut to personal taxes in over a quarter of a century, reducing the tax burden on working families, driving growth through cutting business taxes, and sharing the proceeds of growth."

Chancellor Rishi Sunak is 'balancing budget on the backs of the poor'

Speaking on LBC's Swarbrick on Sunday, Mr Ashworth also said: "We've had 12 years of hacking at the roots of growing our economy."

He added: "What we've got is low growth, high tax and stretched public services."