Ian Payne 4am - 7am

3 November 2022, 18:46

The CEO of Mumsnet has said people who aren’t on benefits are getting in debt from simply buying essential household items.

Data from the popular website, which has about 8million unique users from across the economic scale every month, breaks down what people are taking about.

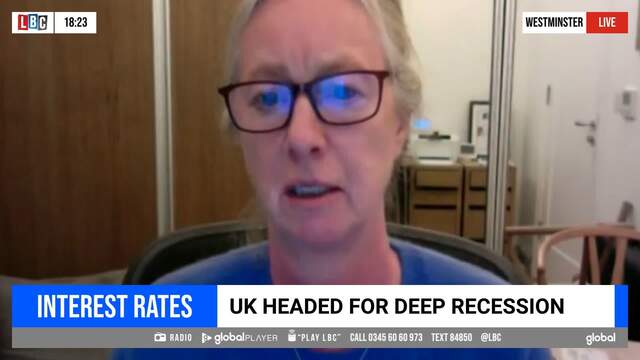

Speaking on the Andrew Marr show tonight as the Bank of England spoke of the longest recession since World War II, Justine Roberts warned that there’s a ‘lot of nasty consequences around the corner’.

'That phrase compassionate Conservatism has got to be a bit stretchier than it has been so far.'

She said that a cost-of-living tracker on the website revealed 37% of people are going without gas and electric that they would normally be using this time of year and another 15% are in debt from buying essentials.

She said: “It’s affecting everyone,

“There’s already a lot of discussion around Christmas and preparing their children for Christmas – things like ‘you’re not going to have as many presents this year’.”

She said the situation will get much worse as parents take on debt to pay for childcare so they can go to work and with a hike in interest rates, ‘there’s a lot of nasty consequences around the corner’.

When asked what she would ask Rishi Sunak, she said: “[The government] has spoken more words about protecting the most vulnerable but a lot of people are falling into that net now, not just the obvious candidates but all people who are above universal benefit level who are really struggling going into debt meeting their daily finances and I think they should treat it as an emergency what it effectively is.”

READ MORE:Britain faces 'longest recession in history' as Bank of England hikes interest rate 0.75% to 3%

Andrew Marr asked if any blame was being apportioned and she confirmed: “They’re frustrated with the government, when we asked 1 in 10 said they trusted the government to help them out of this mess.”

Blame on the cost-of-living crisis is also being put on big oil companies, big tech companies like Amazon and even people who are ‘very rich’.

She also said there has been interesting discussions around mortgages which despite ‘having gone through the roof’ families say they will be cutting back on ‘nearly everything’ to be able to afford it.