Nick Abbot 10pm - 1am

22 November 2023, 19:56

Rachel Reeves has told LBC that the decision to cut National Insurance "was the right thing to do", but warned it "won't make up for the rising tax burden on working people".

Speaking to LBC's Iain Dale, the Shadow Chancellor said she has previously campaigned against rises in National Insurance, a tax on "working people".

If elected into power, the Labour government would keep today's National Insurance cut (two per cent), and will vote in favour of legislation passing it through, Ms Reeves told LBC.

“Taxes on working people have gone up very sharply. in fact, if you add up all the tax increase on personal taxation - income tax and national insurance it’s equivalent to a 10p rise in NI," she said.

"What he did today was a 2p cut, but of course that doesn’t cancel the 10p rise."

As for the Chancellor's Autumn Statement as a whole, Ms Reeves said it represents the Tories' "eleventh growth plan in 13 years".

Speaking after Jeremy Hunt's Autumn Statement, she said: "The Chancellor claims the economy has ‘turned a corner’, yet the truth is that under the Conservatives growth has hit a dead end."

Rachel Reeves explains how she would inspire 'sick and tired' Tory voters to choose Labour

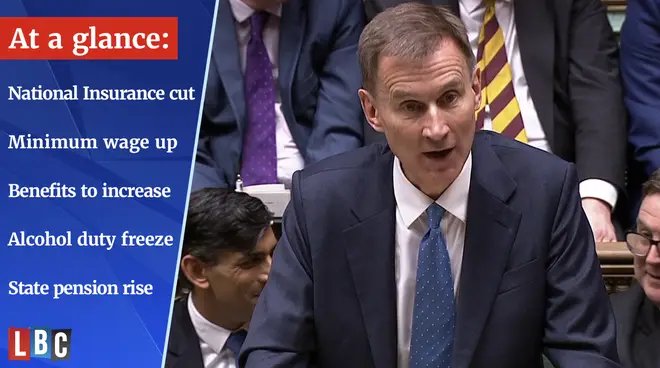

The Chancellor hopes to revive Tory fortunes ahead of a looming General Election by pledging 110 measures to help the economy, including a cut to National Insurance.

He slashed National Insurance by two percentage points from January, saving workers on a salary of £35,000 £450.

The Chancellor said: “If we want people to get up early in the morning, if we want people to work nights, if we want an economy where people go the extra mile and work hard then we need to recognise that their hard work benefits all of us.

“So today, Mr Speaker, I am going to cut the main 12% rate of employee National Insurance. “If I cut it by 1 percentage point to 11%, that would be an extra £225 in the pockets of the average worker every year.

Follow the latest Autumn Statement news on Global Player, the official LBC app

"But instead, I’m going to go further and cut the main rate of Employee National insurance by 2 percentage points from 12% to 10%. This change will help 27 million people.”

But Shadow Chancellor Rachel Reeves said that people in work are "worse off" despite Mr Hunt's announcements. She added that the British public "will not be taken for fools".

The UK has become "world-following, not world-beating" under the Tories, she said.

Mr Hunt also said he is scrapping Class 2 National Insurance, paid by many self-employed workers, which would save the average self-employed person £192 per year.

He further announced self-employed people who pay "Class 4" National Insurance at 9% on all earnings between £12,570 and £50,270 will see that cut by 1 percentage point to 8% from April.

For pensioners, he announced the triple lock will stay, meaning an 8.5 per cent rise in the state pension.

Benefits will also increase by 6.7% and duties on beer, wine and spirits in pubs and bars are being frozen - and bars will have their 75% business rates holiday extended.

Mr Hunt said the country needs a “more productive state not a bigger state” and said that the UK economy is set to grow by 0.6% in the current year, according to forecasts from the OBR.

Mr Hunt told MPs: “After a global pandemic and energy crisis, we have taken difficult decisions to put our economy back on track.”

A Downing Street spokesman added: "The Chancellor said that his statement was one that backs business and rewards workers to get Britain growing."

Follow the latest Autumn Statement news on Global Player, the official LBC app

The Government has already announced an increase in the national living wage, up from £10.42 to £11.44 from April, with the policy also extended to cover workers aged 21 and over, rather than 23 and over.

Read More: Autumn Budget tax cuts would be 'politically risky' for Tories, top economist tells LBC

It will mean a £1,800 annual pay rise next year for a full-time worker on the living wage, while 18 to 20-year-olds will receive a £1.11 hourly rise to £8.60.

Treasury Chief Secretary Ms Trott had already indicated that workers could be in line for a tax cut. She said that the Government would focus on "cutting taxes for individuals".

Prime Minister Rishi Sunak plans to launch a 'work from home' drive in a bid to get sick Brits off benefits and into a job.

Under the plans, which will be launched as part of a series of measures in Wednesday's Autumn Statement, hundreds of thousands of disabled Brits will be told to look for jobs they can do from home.

That includes Brits with mobility and mental health problems.If not, they could have their benefits reduced by nearly £4,700 a year. It will apply to all new benefit claimants from 2025.

Meanwhile, existing claimants will reportedly be given assurances that their right to benefits will not be re-assessed if they look for a job they can do from home.

'Is he making excuses or promises - which is the PM better at?': Nick Ferrari challenges Chief Secretary to the Treasury Laura Trott

Speaking to LBC's Nick Ferrari at Breakfast, Chief Secretary to the Treasury Laura Trott claimed Rishi Sunak is making progress on all five of his pledges.

When it was put to her that the Prime Minister has failed to deliver on most of the promises he made at the start of the year, Ms Trott told Nick: "I would refute that."

She said halving inflation was "a really important delivery", that "over the course of the year we have seen growth", and that small boat crossings "are down significantly".

"They were not easy targets, but they are ones where we have made progress on every single one," she said.