Dean Dunham 9pm - 10pm

3 February 2023, 00:00 | Updated: 3 February 2023, 00:16

Millions of Brits are facing a hike in their mortgage payments after the Bank of England's decision to raise interest rates to 4%, with some households facing a rise of nearly £50 per month.

The Bank of England base rate increased from 3.5% to 4% on Thursday, which will have an immediate impact on homeowners whose mortgages directly track it.

However, borrowers on fixed-rate mortgages will not feel the immediate impact, although 1.8 million customers are due to see their fixed-rate deals end in 2023.

The average tracker mortgage payment will increase by £48.99 per month, according to UK Finance, while the average standard variable rate (SVR) mortgage is set to increase by £30.81 per month.

A UK Finance spokesperson said: "Lenders stand ready to help customers who might be struggling with their mortgage payments, with a range of tailored support available.

"Anyone who is concerned about their finances should contact their lender as soon as possible to discuss the options available to help."

It comes after warnings from the Labour Party that homeowners could face mortgage hikes of up to £14,000 a year as they come off low fixed-rate deals.

Analysis by the party predicted annual increases in costs for a median house purchase at 80 per cent mortgage in every constituency in the UK.

The hike in interest rates - the tenth increase in a row - is putting a "significant strain" on households across the country, according to StepChange Debt Charity.

Richard Lane, director of external affairs and operating subsidiaries at the charity, said: "The continued upward trend in interest rates is putting a significant strain on households, on top of existing cost-of-living pressures which show little sign of easing.

"For those on the lowest incomes with the least financial resilience, housing arrears, among other types of debt, are a real risk this year.

"As recently emphasised by the FCA (Financial Conduct Authority), it's vital that firms treat borrowers fairly, including tailored forbearance and signposting to free debt advice, alongside proactively identifying customers who may be teetering on the edge of problem debt.

"Financial difficulty can affect anyone at any time, and current circumstances mean there could be thousands of people struggling with debt in silence. We would urge anyone worried about rising mortgage rates and their ability to meet financial commitments to reach out for help as early as possible."

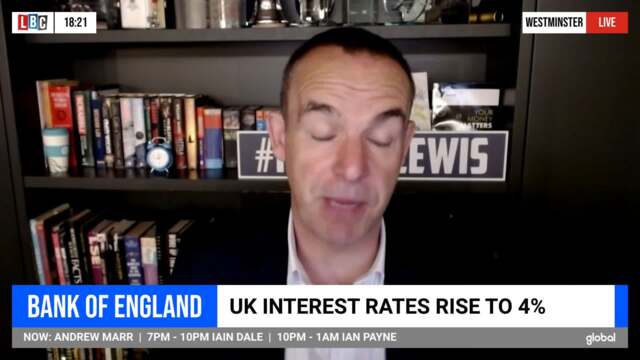

Consumers should not act under the assumption that interest rates will return to where they were after the Bank of England's decision to hike them to 4%, Martin Lewis told LBC yesterday.

Speaking on LBC's Tonight with Andrew Marr, Mr Lewis said interest rates have typically been higher over the last two centuries compared with the last 15 years, which may have been the anomaly.

Martin Lewis says low interest rates may never go back to where they were.

He warned against acting under the assumption that interest rates will return to around 0.5 per cent, which could never happen.

"There are many people out there that tell me 'I'm going to do X and Y and wait until base rates go back down to less than one per cent'," he told LBC.

"I think this happens because [younger people]...have only ever known interest rates of around half a per cent. Since 2007, we have had interest rates that have limboed very substantially below the 200-year historic interest rates.

"It's quite possible that these last 15,16-odd years - that was the anomaly. This isn't the anomaly, that is the anomaly."

He continued: "You cannot make a judgement on the basis that interest rates will go back to where they were. That is absolutely not a certainty."

Read More: Interest rates may never return to as low as they were, says Martin Lewis

Read more: Shell posts record profits of £32.2bn after oil prices surge in wake of Russia's invasion of Ukraine

"They may never go back to where they were - equally, they may go back to where they were, we just don't know."

"But I certainly think those people that they think they must go back to where they were, that is a very big assumption [and] not necessarily one to make your decision on."

The UK is also still due to enter a recession this year, but it will be shorter than previously thought, the bank said.

The slowdown will be down to high energy costs and prices but inflation will slow down and companies are likely to hold off on making staff redundant.

While savers are set to benefit from higher rates, homeowners with mortgages and customers with loans will be hit.

A statement from the Bank said: "Global consumer price inflation remains high, although it is likely to have peaked across many advanced economies, including in the United Kingdom.

"Wholesale gas prices have fallen recently and global supply chain disruption appears to have eased amid a slowing in global demand."

Many central banks have continued to tighten monetary policy, although market pricing indicates reductions in policy rates further ahead."

It said that while headline consumer prices index inflation has started to edge back and will "likely fall sharply" this year, the labour market has stayed "tight" and "price and wages pressures have been strong than expected, suggesting risks of greater persistence in underlying inflation".