Nick Abbot 10pm - 1am

2 February 2023, 19:24 | Updated: 2 February 2023, 22:33

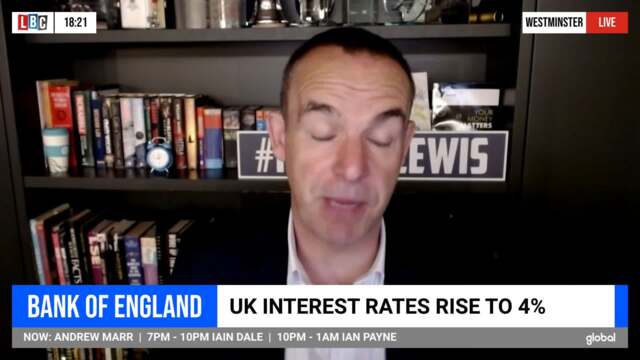

Consumers should not act under the assumption that interest rates will return to where they were after the Bank of England's decision to hike them to 4%, Martin Lewis has told LBC.

Speaking on LBC's Tonight with Andrew Marr, Mr Lewis said interest rates have typically been higher over the last two centuries compared with the last 15 years, which may have been the anomaly.

He warned against acting under the assumption that interest rates will return to around 0.5 per cent, which could never happen.

"There are many people out there that tell me 'I'm going to do X and Y and wait until base rates go back down to less than one per cent'," he told LBC.

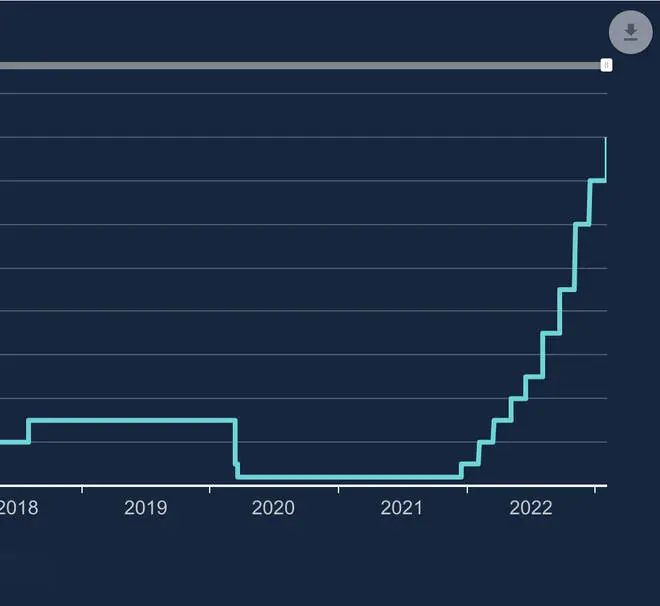

"I think this happens because [younger people]...have only ever known interest rates of around half a per cent. Since 2007, we have had interest rates that have limboed very substantially below the 200-year historic interest rates.

"It's quite possible that these last 15,16-odd years - that was the anomaly. This isn't the anomaly, that is the anomaly."

Watch Tonight with Andrew Marr exclusively on Global Player every Monday to Thursday from 6pm to 7pm.

Martin Lewis says low interest rates may never go back to where they were.

He continued: "You cannot make a judgement on the basis that interest rates will go back to where they were. That is absolutely not a certainty.

"They may never go back to where they were - equally, they may go back to where they were, we just don't know.

"But I certainly think those people that they think they must go back to where they were, that is a very big assumption [and] not necessarily one to make your decision on."

Read more: Shell posts record profits of £32.2bn after oil prices surge in wake of Russia's invasion of Ukraine

It comes after the Bank of England raised the base interest rate to 4% on Thursday - a climb of 0.5 percentage points and the tenth consecutive rise.

The UK is also still due to enter a recession this year, but it will be shorter than previously thought, the bank said.

The slowdown will be down to high energy costs and prices but inflation will slow down and companies are likely to hold off on making staff redundant.

While savers are set to benefit from higher rates, homeowners with mortgages and customers with loans will be hit.

A statement from the Bank said: "Global consumer price inflation remains high, although it is likely to have peaked across many advanced economies, including in the United Kingdom.

"Wholesale gas prices have fallen recently and global supply chain disruption appears to have eased amid a slowing in global demand.

"Many central banks have continued to tighten monetary policy, although market pricing indicates reductions in policy rates further ahead."

It said that while headline consumer prices index inflation has started to edge back and will "likely fall sharply" this year, the labour market has stayed "tight" and "price and wages pressures have been strong than expected, suggesting risks of greater persistence in underlying inflation".

Chancellor Jeremy Hunt said: "Inflation is a stealth tax that is the biggest threat to living standards in a generation, so we support the Bank's action today so we succeed in halving inflation this year."

We will play our part by making sure Government decisions are in lockstep with the Bank's approach, including by resisting the urge right now to fund additional spending or tax cuts through borrowing, which will only add fuel to the inflation fire and prolong the pain for everyone."