Simon Marks 3pm - 7pm

27 February 2020, 23:57 | Updated: 28 February 2020, 00:01

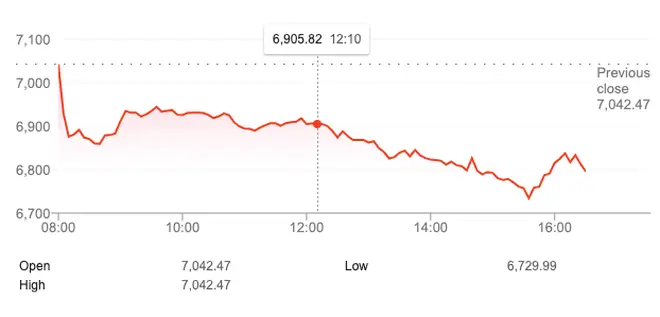

London's stock market has had its biggest fall since the 2008 financial crisis as £152 billion was wiped off the FTSE 100 index amid coronavirus fears.

The London Stock Exchange dropped to a 13-month low, while EasyJet's value was cut by almost a third as worries over the Covid-19 outbreak shocked the markets.

Traders have warned that the disease could lead to "anaemic global growth" as the FTSE 100 - the leading index of the UK's biggest listed companies - fell more than seven per cent since the beginning of the week.

In real terms, this equates to a £152 billion loss for the UK's biggest firms. Since the beginning of 2020, the index has dropped by more than 10 per cent.

It fell a further 3.5 per cent on Thursday trading - the same level experienced on Monday - which is a rate that has not been seen for more than a year.

EasyJet's value dropped by 30 per cent in a week, as holidaymakers postponed trips and businesses reduced travel to other countries as people try to stop the virus from spreading.

David Madden, an analyst at CMC Markets, said: "The week has been awful... as traders are petrified of a pandemic, but today's session has been the most painful.

"The fear factor is ramping up and in turn, we are seeing traders drop stocks at an increasing pace.

"Dealers are rushing for the exit as the chatter about the global economy being hurt because of the coronavirus has risen."

Ben Kumar of Seven Investment Management told LBC's Eddie Mair that investors should not worry too much about the slump, so long as they have not sold stocks.

"As of now, as long as investors haven't sold stocks, they haven't lost that money yet. The FTSE is down, but until you actually sell at a price lower than you bought, it always has the chance to go back up again over the long-term," he said.

European markets suffered a similar fate, with French and German indexes experiencing corresponding slumps.

The Dow Jones in the US also lost 3,400 points in the space of a week, despite President President Donald Trump's intervention last night where he attempted to play down fears of a pandemic.

Globally, the disease has been hitting companies hard with many reporting that coronavirus has affected their profits and trading.

Luxury sports car maker Aston Martin warned that the number of Chinese customers are falling; Asian-focused bank Standard Chartered said the region's economy was suffering, and Microsoft said computer sales were taking a hit.

Those worst affected by the effects of coronavirus fears were airlines and holiday firms.

Shares in Tui, EasyJet and British Airways owner IAG were all down heavily.

Some have put the slump down to the stock market needing a "correction" as it had been performing at record levels in recent months.

However, others have suggested that this freefall was more than just a "correction."

Ipek Ozkardeskaya, of Swissquote bank, said: "The slide we are seeing right now is not the correction of the recent stock rally, but the market's understanding that the coronavirus outbreak would translate into significantly lower earnings and an anaemic global growth.

"If we add the fact that the crisis has only started outside China into the mix, there is a meaningful shift in stock valuations."

Despite some good news for businesses - Reckitt Benckiser revealed sales of cleaning and hygiene products have increased - hopes were dashed on Wednesday when stock markets in the US rose in the morning, but fell as the day progressed, with traders unimpressed with Donald Trump's intervention.

Uncertainty in the markets means that businesses are beginning to assess the impact of a long-term outbreak, and with China accounting for 20 per cent of the world's manufacturing output, the downfall could continue.