Iain Dale 7pm - 10pm

14 October 2022, 02:07 | Updated: 14 October 2022, 08:12

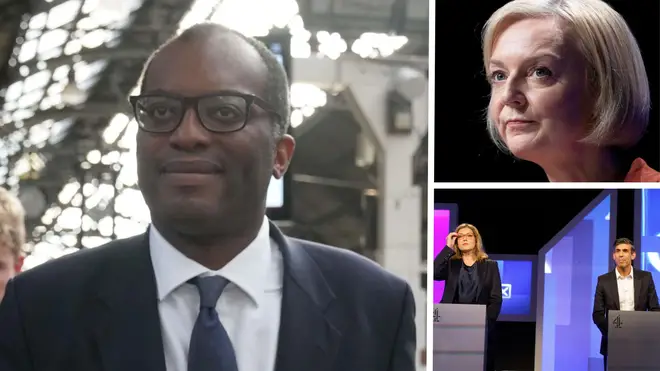

Chancellor Kwasi Kwarteng has cut his US trip short and is rushing back to the UK for talks with the Prime Minister as expectation mounts the pair will U-turn on parts of their mini Budget.

He cancelled meetings at the International Monetary Fund in Washington, flying home a day early for the crunch talks with Ms Truss.

Mr Kwarteng's mini Budget, announced in September, sent the markets into turmoil.

Three weeks on, he and Ms Truss are facing pressure to row back on more parts of the tax-cutting plan after already backtracking on plans to scrap the top rate of income tax.

Mr Kwarteng earlier vowed to fight on after a "baptism of fire", insisting he is "not going anywhere" despite rumours some of his plans will be axed.

"I really enjoy the Treasury," he told the Telegraph.

Read more: King Charles mutters 'dear oh dear' to under-fire Liz Truss as pair meet for weekly audience

Read more: Kwarteng insists no more mini-budget u-turns despite claims government ‘may raise corporation tax’

Ms Truss is considering watering down tax cuts with hopes of saving her premiership.

Options being considered include increasing corporation tax, despite the PM centring her leadership campaign around cancelling Rishi Sunak’s planned rise of the rate.

Downing Street on Thursday did not deny that the potential exists for a reversal on the corporation tax policy, one of the landmark promises made by Ms Truss in her pitch to become Tory leader.

It came amid reports that talks were under way between No 10 and the Treasury on abandoning elements of the £43 billion tax-cutting plan.

Speculation was fuelled further when Mr Kwarteng only said "let's see" when asked about the expectation from financial markets that the Government could ditch its corporation tax promise.

However, it may already be too late for Ms Truss to salvage her role amid a Tory plot to replace her with former rivals Rishi Sunak and Penny Mordaunt.

Discussions are believed to be under way to replace Ms Truss with a "unity candidate", with just one person to succeed the PM.

One senior Tory told The Times: “A coronation won’t be that hard to arrange. In 2019 candidates needed eight MPs to get on the ballot paper. This year they needed 20.

"Next time it will be however high it needs to be for only one candidate to clear it."

They predicted a pact between Mr Sunak and Ms Mordaunt, which would have the support of an overwhelming majority of Conservative MPs.

Around "20 to 30" former ministers and senior backbenchers are attempting to find a way for a "council of elders" to tell Truss to step down, it is understood.

Another MP told the paper: "Rishi’s people, Penny’s people and the sensible Truss supporters who realise she’s a disaster just need to sit down together and work out who the unity candidate is.

"It’s either Rishi as Prime Minister with Penny as his deputy and Foreign Secretary, or Penny as Prime Minister with Rishi as Chancellor.

"They would promise to lead a government of all the talents and most MPs would fall in behind that."

Friday is set to be a crunch day in the financial markets, with the Bank of England's emergency bond-buying scheme due to come to an end.

Officials stepped in two weeks ago after the mini-budget sent markets into chaos amid concerns over higher borrowing costs, triggering concerns in particular about the fate of pension funds.

A growing expectation on Thursday of a Government U-turn on corporation tax appeared to reassure the finance industry, after Bank of England Governor Andrew Bailey spooked the markets by insisting that the emergency support would not be extended.

Despite Ms Truss' leadership being in renewed peril, Mr Kwarteng is insistent that his party can still be trusted with the public finances.

"We're Conservatives. Fiscal discipline runs right through our DNA", he told the Telegraph.

The Government's plans revolve around securing an increase in economic growth - with a target of an annual rise of around 2.5% in GDP.

The crucial date will be October 31, when the forecasts presented by the Office for Budget Responsibility (OBR) alongside the Chancellor's statement will give an assessment on whether such a plan is realistic.