Nick Abbot 10pm - 1am

23 March 2022, 19:37 | Updated: 23 March 2022, 20:53

The Chancellor of the Exchequer has told LBC that "every penny" of the increased National Insurance tax will go "directly " into funding the NHS and social care.

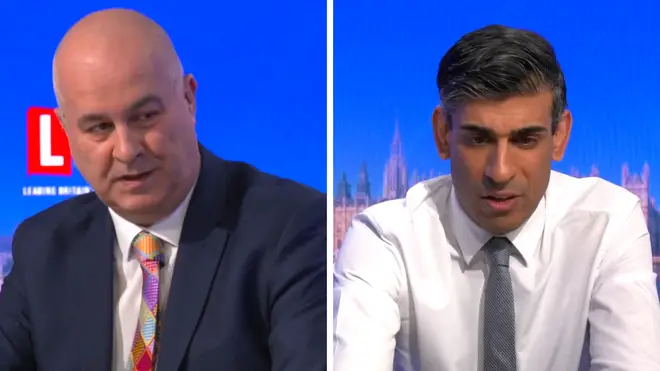

Speaking to LBC's Iain Dale, Rishi Sunak hit back at suggestions that the change to income tax coupled with the increase to NI payment was "rewarding those with unearned income and taxing jobs".

When asked why he did not keep income tax at 20 per cent, and abolish the rise to NI contributions Mr Sunak said: "The big difference for this new levy is that for the first time ever, and people are going to see it on their payslips, starting soon and then in more detail next year, we will have a dedicated funding stream for the thing that we all care most about and that is the NHS and social care.

"And for the first time we will have a specific tax where every penny that you pay you know with confidence, legally, is going to go directly to the thing that you care most about.

Defending his decision he added: "Everyone has been reading and hearing about the backlogs and many peoples families will be experiencing this yourselves, the wait time for getting your treatment.

"I don’t think that’s right and I know that there is a team at the NHS that are really committed to working hard to work on that backlog and get it down but they need funding to do that."

Read more: Ukraine win would be 'one of the great underdog victories in history', says Andrew Marr

Read more: Met police need to find 'speedy resolution' to Partygate scandal, minister tells LBC

Rishi Sunak defends National Insurance rise

The Chancellor said he was "working day and night" to help people struggling with the soaring cost of living, insisting he was "on peoples side".

When grilled by Iain Dale on whether his multimillion pound wealth impacted his ability to "relate" to those struggling to heat homes and feed their children, Mr Sunak replied: "You know I am sitting here now as the product of a lot of sacrifice and a lot of kindness from lots of people in my life.

"Starting with my grandparents who emigrated here from India and elsewhere you know without a lot and my parents worked their socks off and sacrificed a lot to provide opportunities for me and my younger brother and sister, notably education.

"And that was important to them and they thought that would be for us the springboard for creating a better life for us and you know I am really grateful that they did and that is why I am sitting here talking to you tonight in this job.

Read more: Brits face biggest tax burden since 1940s despite Rishi's £6bn giveaway

Read more: Cuts to fuel, tax and VAT: Spring statement key points at a glance

Rishi Sunak put on the spot over his privilege

"And of course I am cognisant that not everyone has had those same opportunities, and I have been fortunate, but that is why I work day and night in this job to spread those opportunities to make sure as many people as possible have the same types of opportunities.

"And I'm making sure that I'm on peoples side and I'd say judge me by my actions.

"People have seen me in this job for a couple of years, they’ve seen the kinds of things I've done, they've probably remember those press conference right at the beginning, when I got this job and we locked down pretty much two years ago to the day, and then I had to introduce furlough.

"And I said to people look we will be with you through this very difficult period that we are about to go through, we will be companionate about how we do it and I think that people can hopefully can judge me on those actions."

Read more: Concert for Ukraine: Chancellor announces VAT on tickets to be donated to charity

Read more: 'The NHS is very well funded': Treasury minister dodges question on impact of NI change

Sunak denies he is 'embarrassed' to raise taxes

Later in the show Iain Dale quizzed Mr Sunak on his decision to increase taxes, saying: "You are pitching yourself as a tax cutting Chancellor, as any Conservative Chancellor would do, but you have raised more taxes in the last two years than any chancellor in the last 50 years.

"Our tax burden is going up from 33 per cent of GDP to 37 per cent of GDP by 2026/27. Don't you get embarrassed by those figures as a Conservative Chancellor who tries to say that he is a tax cutting Chancellor?"

To which he replied: "Iain I am also the Chancellor who had to deal with the once in a century pandemic, I am also the Chancellor who had to experience to biggest economic shock to the country for 350 years.

"We saw borrowing spiral to levels we haven't seen since world war two, I am the Chancellor who had to introduce furlough.

"So yeah I have to deal with the world as it is, not as the way I would like it to be."

Read more: 'What more can I do?': Desperate mum with 3 jobs who rations heating pleads with Sunak

Read more: Ring Rishi with Iain Dale | Watch again

Rishi Sunak defends National Insurance rise

His comments come after his announcement of the Spring Statement where he unveils plans to raise the national insurance threshold, cut income tax and slashed fuel duty tax.

In his statement, he announced that he is increasing the rate at which workers start paying National Insurance to £12,570 - bringing the threshold in line with Income Tax from July this year.

The Chancellor, who recognised the impact of Russia's invasion of Ukraine, also confirmed he is cutting fuel duty by 5p for a year.

He told MPs that the basic rate of income tax will also be cut from 20p to 19p in the pound by the end of this Parliament - 2024.

He said this equates to a £5bn tax cut for 30 million people.

Read more: Martin Lewis: Rishi's Spring Statement 'peanuts compared to cost of living crisis'

Read more: Ukrainian family of 10 move into house in Cambridgeshire donated by local businessman

Would Rishi Sunak like to be PM one day? Iain Dale asks

Mr Sunak said he wanted people to know the Government will "stand by them" in dealing with rising living costs, telling MPs: "Today I can announce that for only the second time in 20 years, fuel duty will be cut.

"Not by one, not even by two, but by 5p per litre. The biggest cut to all fuel duty rates - ever."

But the Office for Budget Responsibility (OBR) said the amount of tax paid compared to GDP, or gross domestic product, will hit the "highest level since the late 1940s" in the following years.

It says net tax rises plus the "more tax-rich composition" of forecasted economic activity raises the tax burden from 33% of GDP in 2019/20 to 36.3% in 2026/27.

Its fiscal outlook says this is the "highest level since the late 1940s", adding that this "is a 3.3% of GDP increase in the tax burden in the space of seven years".