Dom Joly 7pm - 10pm

5 February 2021, 07:55

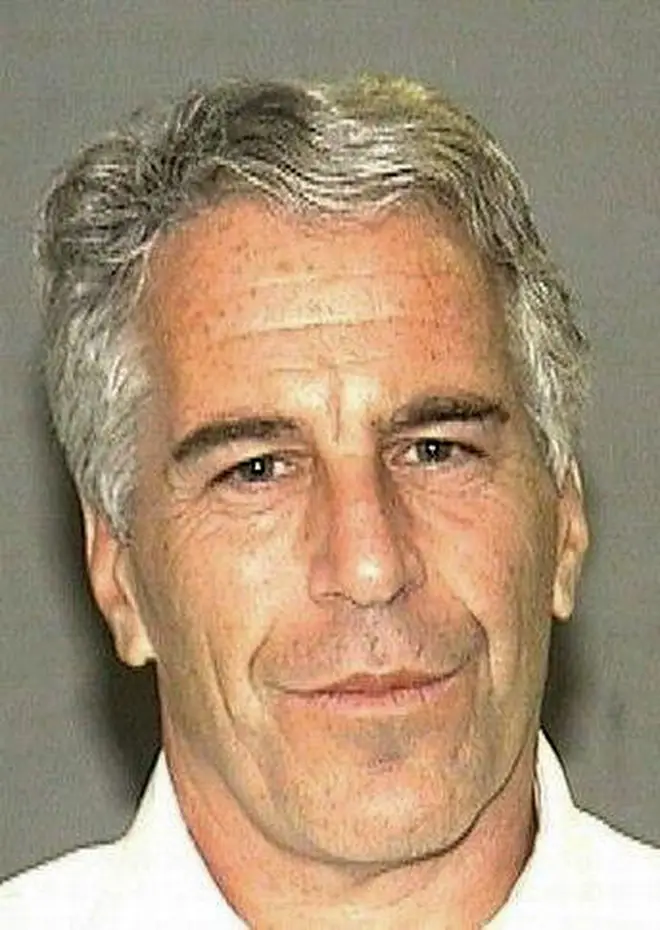

A compensation programme supposed to provide money to dozens of women who said they were abused by financier Jeffrey Epstein has abruptly suspended payouts, saying it has temporarily run out of cash.

The announcement by the Epstein Victims' Compensation Programme came through a release that blamed the suspension on uncertainty about the liquidity of estate assets needed to finance payouts.

Officials said the fund would have up to 630 million dollars (£460 million) when it started its operations last June.

But the shutdown came after only 50 million dollars (£37 million) had been paid out, according to a release put out by the fund, which was established with the approval of a judge in the Virgin Islands.

It said payments will not resume before March 25, the deadline to file claims. The deadline to register for the programme is Monday.

According to the release, the programme's 150 claims to date have far exceeded expectations; when the fund began, the programme said there was expected to be over 70 claims.

Jordy Feldman, the fund's administrator, said the suspension of payouts was necessary to protect those who have not yet resolved their claims.

"Issuing a compensation offer that cannot be timely and fully funded and paid, consistent with the way the Programme has operated to date, would compromise claimants' interests and the guiding principles of the Programme," Mr Feldman said.

The fund provides an alternative to pursuing claims through the courts. Working with Mr Feldman is Kenneth Feinberg, a well-known mediator who oversaw compensation funds for victims of the September 11 attacks and of clergy sex abuse within New York's Roman Catholic archdiocese.

It was established after Epstein, 66, killed himself at a Manhattan federal jail in August 2019 while he awaited trial on sex trafficking charges that alleged he abuse women and girls under the age 18 at his Florida estate and his Manhattan mansion in the early 2000s.