Nick Abbot 10pm - 1am

11 May 2023, 12:05 | Updated: 11 May 2023, 12:51

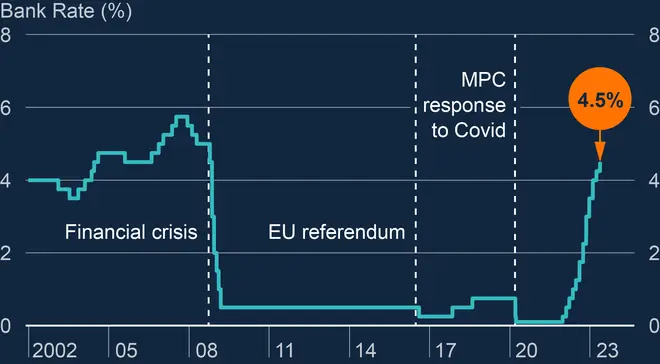

The Bank of England has announced another rise in interest rates to to 4.5% - the 12th increase in a row.

Rates are now at their highest level for 15 years, since the global financial crisis in 2008, after seven out of nine members of the Bank's monetary policy committee (MPC) voted for the increase.

The previous rate was 4.25%, after an increase of 0.25 percentage points in March. The two members who wanted to keep rates at 4.25% pointed out that inflation was already on course to fall this year.

But the Bank warned that the increase in the cost of living is expected to fall slower than previously thought.

The latest increase in interest rates is set to make life even more difficult for people on variable mortgages and some people with credit cards and overdrafts.

Some analysts believe that mortgage rates are unlikely to come down significantly for the rest of 2023.

Simon Gammon, managing partner at Knight Frank Finances, said: "The biggest conundrum for most borrowers at the moment is whether to fix for two years or take a tracker. Of course, that comes with the risk that your monthly payments will rise if the Bank of England opts to raise interest rates further, so it's a highly personal decision."

Announcing the decision to hike rates again, the Bank's MPC said there had been "repeated surprises about the resilience of demand" and that inflation had been stronger than expected as the price of food and other goods were higher amid the war in Ukraine.

The two members of the MPC who wanted to keep rates unchanged said that inflation was already expected to fall considerably this year without the need to rise the rate again.

They also said a lot of the impact of rising rates has not yet come through into the economy. The Bank estimates that around a third of the impact of rates increases has been passed through.

In a report, the committee said: "In the modal forecast conditioned on market interest rates, and taking account of stronger paths for food prices and demand growth, CPI inflation is expected to decline somewhat less rapidly compared with the February report."

Speaking about the troubles that have hit banks in recent months, committee members added: "Risks remain but, absent a further shock, there is likely to be only a small impact on GDP from the tightening of credit conditions related to recent global banking sector developments."

They said: "The committee judges that growth over much of the forecast period will be materially stronger than in the February report.

"This reflects stronger global growth, lower energy prices, the fiscal support in the spring Budget and the possibility of lower precautionary saving by households than previously thought."

Chancellor Jeremy Hunt said the interest rate rise would "obviously be very disappointing for families with mortgages.

"But unless we tackle rising prices, the cost of living crisis will only carry on - which is why we need to be resolute in sticking to our plan to halve inflation by the end of the year."

Meanwhile, economists at the Bank released a record upgrade to their economic growth expectations.

They now expect that gross domestic product (GDP) will not fall during a single quarter this year, meaning the economy is not set to decline and the UK could avoid a recession.

In February, the committee believed the economy could fall into a shallow recession starting from the first three months of the year.

The increase of 2.25 percentage points over the three-year forecast period marked the biggest upgrade since the MPC was formed in 1997.

"The improved outlook reflects stronger global growth, lower energy prices, the fiscal support in the Spring Budget, and the possibility that a tight labour market leads to lower precautionary saving by households," the report explained.

Nevertheless, higher food and energy prices will continue to disproportionally hit families on lower incomes as the items typically make up a larger share of overall spending, the Bank said.

Just two of the Bank's nine-member MPC voted to keep interest rates the same at 4.25%.