Henry Riley 4am - 7am

2 February 2023, 12:04 | Updated: 2 February 2023, 13:04

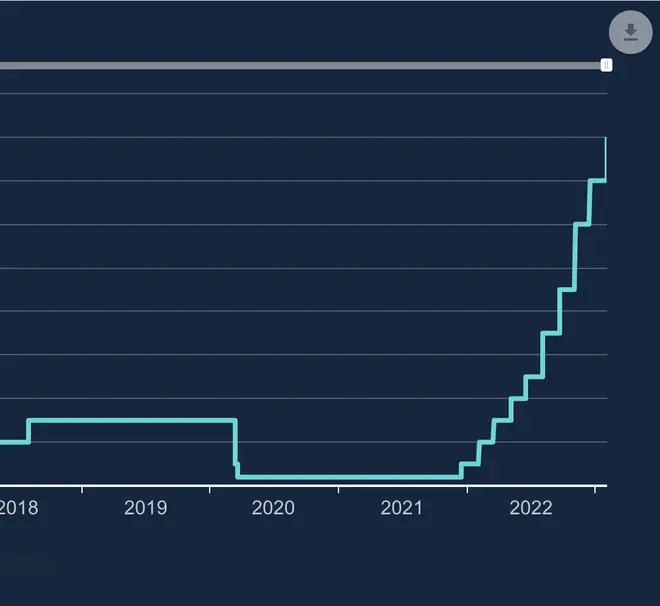

The Bank of England has raised the base interest rate to 4% - a clim of 0.5 percentage points and the tenth consecutive rise.

The UK is also still due to enter a recession this year, but it will be shorter than previously thought, the Bank said.

The slowdown will be down to high energy costs and prices but inflation will slow down and companies are likely to hold off on making staff redundant.

While savers are set to benefit from higher rates, homeowners with mortgages and customers with loans will be hit.

A statement from the Bank said: "Global consumer price inflation remains high, although it is likely to have peaked across many advanced economies, including in the United Kingdom.

Read more: Shell posts record profits of £32.2bn after oil prices surge in wake of Russia's invasion of Ukraine

"Wholesale gas prices have fallen recently and global supply chain disruption appears to have eased amid a slowing in global demand.

"Many central banks have continued to tighten monetary policy, although market pricing indicates reductions in policy rates further ahead."

It said that while headline consumer prices index inflation has started to edge back and will "likely fall sharply" this year, the labour market has stayed "tight" and "price and wages pressures have been strong than expected, suggesting risks of greater persistence in underlying inflation".

Chancellor Jeremy Hunt said: "Inflation is a stealth tax that is the biggest threat to living standards in a generation, so we support the Bank's action today so we succeed in halving inflation this year.

"We will play our part by making sure Government decisions are in lockstep with the Bank's approach, including by resisting the urge right now to fund additional spending or tax cuts through borrowing, which will only add fuel to the inflation fire and prolong the pain for everyone."

But shadow chancellor Rachel Reeves described the knock-on effect of rates rises to homeowners as a "Tory mortgage penalty", saying families will worry about the hike hitting their finances.

"The reality is that under the Tories, growth is on the floor, families are worse off and we are stuck in the global slow lane.

"We do not have to continue on this path of managed decline when Britain has so much potential to grow and thrive."

Confederation of British Industry deputy chief economist Anna Leach said: "The Bank's decision this month shows that it is still too soon to call an end to peak interest rates.

"While inflation is coming down thanks to lower energy prices, labour market shortages and broader inflationary pressures mean higher rates are still needed to bring inflation back to the 2%c target.

"Rising interest rates, high inflation and tightening fiscal policy will challenge economic growth this year.

"The Government needs to act decisively in the forthcoming Budget to reinforce the UK's position as a global centre for innovation and the low carbon economy."

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said: "Another substantial hike in interest rates will come as a painful blow to people and companies already struggling under a myriad of other soaring cost pressures, with borrowers particularly affected.

"The aggressive rate rises over the past year will increasingly drag on our economic prospects in 2023 as they filter into the broader economy, stifling activity and weakening confidence.

"With inflation projected to ease sharply, today’s rise should be the last of this magnitude. If we do slide into recession, then policymakers may be forced to reverse policy sooner than many expect."