Clive Bull 1am - 4am

3 October 2022, 09:41 | Updated: 3 October 2022, 09:48

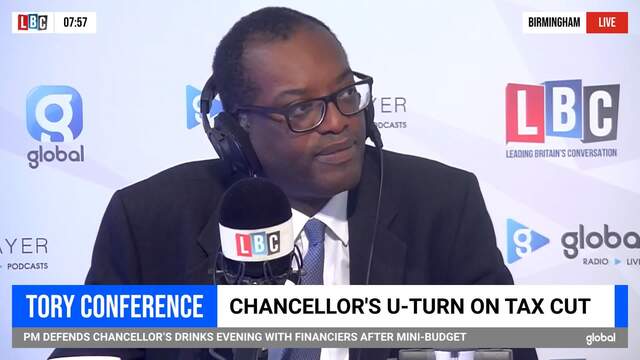

Kwasi Kwarteng has admitted that "in hindsight" it was not wise for him to have attended an event with hedge fund managers shortly after his mini-budget that sent the markets into turmoil.

The Chancellor, who has now U-turned on his controversial plan to scrap the 45p top rate of income tax, was reported to have met with financiers at a drinks do shortly after.

Mr Kwarteng told LBC's Nick Ferrari he "totally" understood how it looked bad to meet with them as the financial system entered turbulence from the fallout of his tax shredding budget, which benefitted earners on higher incomes.

It was reported he had been encouraged to stick to his plans at the gathering on September 23 with questions raised over whether any of the guests would have benefitted from the pound crashing.

Read more: Kwarteng fails to rule out further U-turns after humiliating 45p tax cut reversal

He told Nick: "I spent, I think, a quarter of an hour there, maybe a bit longer, and it was a party event, we have party events all the time that I go to all the time.

"It was a Conservative Party even which had been booked in for a few weeks actually, and as you remember it was a very difficult time with Her Majesty’s passing, we had a funeral, there were dates moving around.

Chancellor regrets going to party with bankers on mini-budget day

"And the dates with that seemed to coincide with the mini-budget."

He added: "I think it was a difficult call and I totally get how it looks, and I just feel that it was something I was signed up to do and had to do."

Pushed on whether he would have gone with the benefit of hindsight, the Chancellor said: "With hindsight it probably wasn't the best day to go."

His mini-budget was followed by the pound tumbling against the dollar and the Bank of England had to make an extraordinary intervention to buy up £65bn of Government bonds when it began to fear some pension funds were at risk of collapse.