Henry Riley 4am - 7am

4 November 2022, 22:51 | Updated: 5 November 2022, 09:33

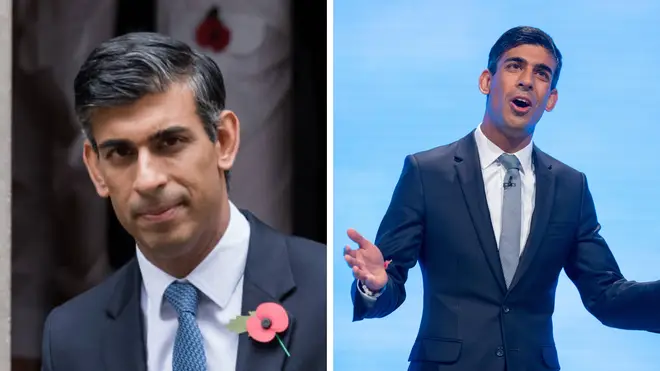

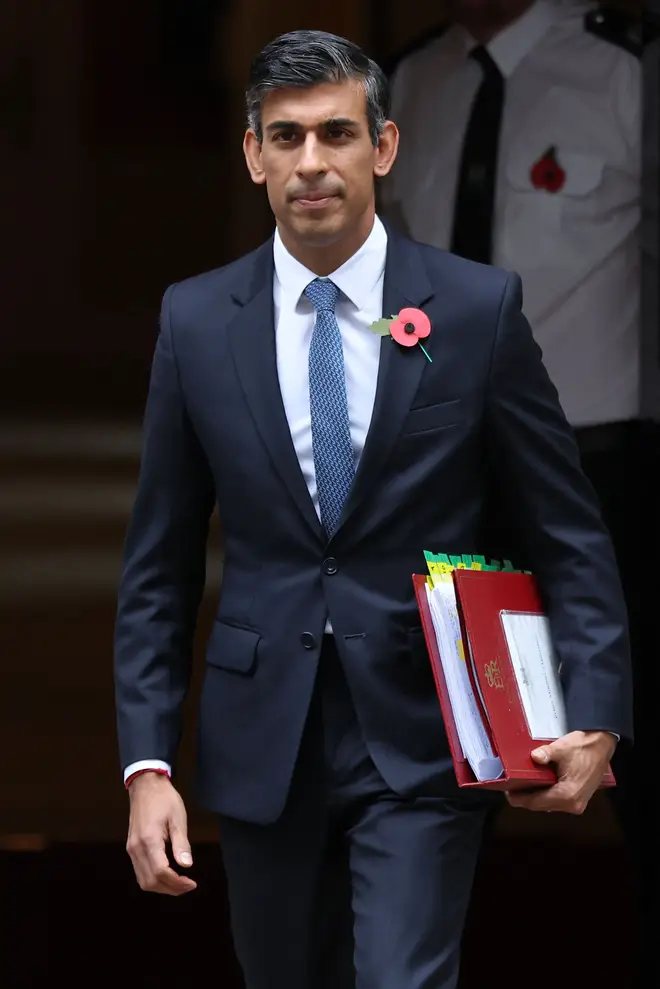

Rishi Sunak has warned that "the government cannot do everything", while pledging to get a grip on inflation, as the UK faces its longest-ever recession.

The Prime Minister said he was doing everything possible to tackle inflation and curb rises in mortgage repayments, after the Bank of England raised interest rates to slow rising prices.

On Thursday, the Bank warned the country is facing the longest recession in a century as it hiked base rates by 0.75 percentage points to 3% - their highest level in 15 years.

Mr Sunal told the Times on Friday: "I absolutely recognise the anxiety that people have about mortgages. It's one of the biggest bills people have," he said.

"So what I want to say to people is that I'm going to do absolutely everything I can to grip this problem, to limit the rise in those mortgage rates.

"I think inflation is the number one enemy, as Margaret Thatcher rightly said. Inflation has the biggest impact on those with the lowest incomes. I want to get a grip of inflation."

Mr Sunak said it was important the Government was honest with voters about the "trade-offs" the country faced in Chancellor Jeremy Hunt's forthcoming autumn statement.

"Everyone appreciates that the Government cannot do everything.

"How does government do everything? It just does it by borrowing money which ultimately leads to, as we saw, high inflation, a loss of credibility, spiking interest rates," he said.

Among the measures being considered by the government is a "stealth raid on pensions" in a bid to close the yawning gap in the public finances, according to reports.

Chancellor Jeremy Hunt and Prime Minister Rishi Sunak are considering freezing the pension lifetime allowance for another two years until 2027, the Telegraph has reported.

That would mean two million more people would face the highest rate of taxes on their pensions - at 55%.

The latest tax rise news comes after reports that Mr Hunt is also planning to increase the headline rate of capital gains tax, which targets the profits made from selling assets.

The government is also looking at changing the reliefs and allowances on the tax, alongside an increase in dividend taxes, and a cut to the tax-free dividend allowance from £1,000 to £2,000, in its autumn statement on November 17.

It comes amid concerns that the government could scrap the 'triple lock' on state pensions, which ensures they rise by inflation, average earnings, or 2.5%, whichever is highest.

The pension lifetime allowance is currently £1,073,100. Savings over that figure withdrawn all at once will incur a 55% tax rate.

For example, someone withdrawing £100,000 would have to hand over £55,000 to the government.

Withdrawing an amount over the allowance gradually incurs a tax rate of 25%, as well as income tax.

The allowance normally goes up with inflation, but Mr Sunak froze the increase last year to 2025, in his role as chancellor at the time.

A former Conservative pensions minister slammed the proposal on Friday night.

Baroness Altmann told the Telegraph: “People in the NHS and other parts of the public sector will increasingly be driven to retire early, rather than work longer like we need them to.

“That is because tax rules that were meant to be a workplace benefit are becoming a workplace penalty. This is the economics of the madhouse.”

Business Sec: Pension funds almost went bust due to risky investments

A pensions consultant warned that extending the freeze could put some people off from saving for retirement altogether.

Steve Webb, of the consultancy LPC, said: "If the current freeze is extended even further, we could easily see two million people in the workforce having to start to think about capping their pension savings in order to avoid tax charges.

“Double-digit inflation means that this policy has been much more brutal than first anticipated and extending the freeze for another two years would make the lifetime allowance a mainstream concern for literally millions of people.

“This would add unwelcome complexity to the system and could easily put people off saving into a pension at all.”

Pensions paying more than working for the NHS

Mr Hunt warned of "eye-watering" public spending cuts and tax increases when he became chancellor in October, following the market turmoil caused by his predecessor Kwasi Kwarteng's proposal of unfunded tax cuts for those on the highest incomes.

And he and Prime Minister Rishi Sunak, who replaced Liz Truss last week, are reportedly determined that much of the economic burden should fall on those with "the broadest shoulders".

It comes after the Bank of England warned on Thursday that the UK is on course for the longest recession since reliable records began a century ago, as it hiked interest rates by 0.75% in an attempt to control inflation.

The 0.75% rise is the single biggest increase since 1989 and could see mortgage holders get hit by £3,000 a year.

It is also the eighth time in a row that the Bank hikes interest rates, which mortgages are set against.

Less than a year ago the rate was 0.1%.

The Bank of England's governor Andrew Bailey said there is a "tough road ahead" but the Bank needed to act to tackle inflation.

Recent figures show inflation soared to 11.6% in October, with basics such as tea bags, milk and sugar all seeing significant price rises as the cost of living crisis continues.

While Mr Bailey admitted the rises are "big changes and they have a real impact on peoples' lives" but warned that "if we do not act forcefully now, it would be worse later on."

However, he added that "we think Bank rate will have to go up by less than is currently priced in by financial markets" meaning "fixed rate mortgages should not need to rise as much as they have done".