Nick Abbot 10pm - 1am

29 February 2020, 00:22 | Updated: 29 February 2020, 00:26

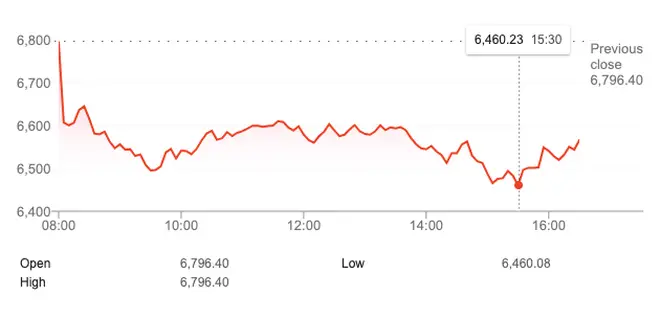

More than £210 billion has been wiped off the FTSE 100 index due to coronavirus fears, signalling the biggest drop in the value of shares since the 2008 financial crisis.

The London Stock Exchange's top 100 companies saw the value of their shares drop by 13 per cent this week, including £58 billion on Friday.

Global stock markets have plunged amid coronavirus fears, with the Dow Jones opening significantly lower on Wall Street - losing 463 points - and Nasdaq falling by 1.7 per cent, or 143 points.

Germany's DAX fell as much as five per cent before stabilising and Tokyo and Shanghai closed 3.7 per cent lower.

Outbreaks in Italy, South Korea, Japan and Iran have frightened investors and fuelled fears that the virus is turning into a global threat.

Anxiety intensified after the US reported its first case of someone contracting the infection, despite not travelling abroad or being in contact with anyone who had.

In Europe, London's FTSE 100 sank 2.9 per cent to 6,599 and Frankfurt's DAX tumbled 3.3 per cent to 11,955. France's CAC 40 lost 2.7 per cent to 5,346. The Stoxx Europe 600 index is also heading for its sharpest weekly drop since October 2008.

Markets in China and Hong Kong had been doing relatively well despite virus fears.

However, major companies are issuing profit warnings, saying factory shutdowns in China are disrupting supply chains. They say travel bans and other anti-disease measures are hurting sales in China, an increasingly vital consumer market.

On Thursday, the FTSE 100 dropped to a 13-month low, while EasyJet's value was cut by almost a third as worries over the Covid-19 outbreak shocked the markets.

Traders warned that the disease could lead to "anaemic global growth" as the FTSE 100 - the leading index of the UK's biggest listed companies - fell more than seven per cent since the beginning of the week.

In real terms, this equated to a £152 billion loss for the UK's biggest firms. Since the beginning of 2020, the index has dropped by more than 10 per cent.

It fell a further 3.5 per cent on Thursday trading - the same level experienced on Monday - which is a rate that has not been seen for more than a year.

EasyJet's value dropped by 30 per cent in a week, as holidaymakers postponed trips and businesses reduced travel to other countries as people try to stop the virus from spreading.