Natasha Devon 6pm - 9pm

7 February 2021, 13:15

Business rate holiday will stop businesses going off 'a cliff edge'

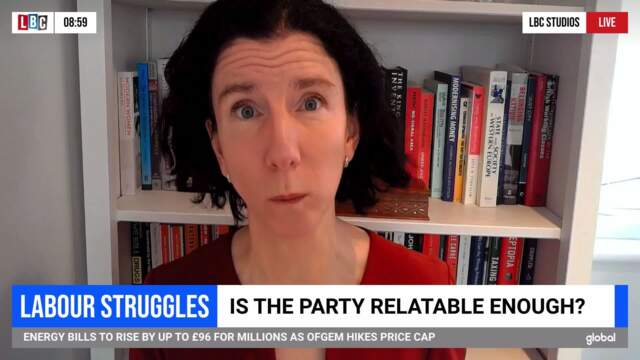

The shadow business minister has told LBC’s Swarbrick on Sunday that up to 250,000 businesses could go bust within the next few months without extra Government support.

Lucy Powell said businesses face a “cliff edge” in March, unless the government extends the business rates holiday.

Labour are calling for the business rate holiday and 5 percent VAT reduction to be extended, to “get cash flow to businesses right now”.

The current measures are set to expire on 31st March, although the Treasury has hinted that they may be extended in the chancellor’s Budget Statement on 3 March.

Despite this, Labour say businesses cannot afford the uncertainty of waiting another month, particularly “when they are trying to get back on their feet”.

Ms Powell told LBC’s Tom Swarbrick the government’s support package, introduced in the first lockdown, “wasn’t designed for businesses to have to be living like that for 12 to 18 months”.

Read more: Scars of Covid will 'last for a very long time', former Chancellor Ken Clarke tells LBC

Read more: Bank of England tells banks to start preparing for negative interest rates

Lord Clarke predicts massive economic bounce back after lockdown

The “huge cliff edge facing business at the end of March” could “take a massive toll on the economy”, the Labour front bencher added.

“They have got to smooth this journey out. The Federation of Small Businesses, which represents small businesses around the country, are now estimating that without some extra support, like the measures we are announcing today, 250,000 businesses could go bust in the next few months.”

Extending the business rates holiday “is the most important thing right now”, she added.

Read more: Surge testing deployed in several areas after South African Covid variant detected

Read more: Storm Darcy: Parts of England wake up to snow as bitter winds grip the nation

Tight lockdown measures until at least May, SAGE member warns

“Obviously corporation tax is different because that is based on profits. For most businesses we are talking about - businesses in distress - there won’t be any profits for this financial year, so there won’t be a corporation tax liability into next year.

“Most businesses I speak to have obviously operated at a great deal of loss this year, so that is not going to impact businesses today.”

The intervention comes as the latest Office for National Statistics figures revealed almost half of the hospitality and accommodation workforce and 56% of the arts and culture workforce were fully or partially furloughed in the two weeks to January 10th.

Read more: Chancellor offers businesses more time to make first Covid loans repayment

Read more: Party-goers fined £11k after celebrating one-year-old's birthday in a small flat

Shadow Chancellor backtracks after branding Labour strategy "spin"

Positioning themselves as the “party of work and business”, Labour Shadow Chancellor Annelise Dodds, slammed Chancellor Rishi Sunak for acting “at the last minute time and again during this crisis”.

“Britain can’t afford the Chancellor to make the same irresponsible mistake all over again.

“He must announce these continued tax cuts now, not wait another month and risk even more job losses.”