Iain Dale 7pm - 10pm

11 March 2020, 07:31 | Updated: 11 March 2020, 09:29

The Chancellor is set to set out a series of measures to combat the threat of coronavirus in the Budget this lunchtime.

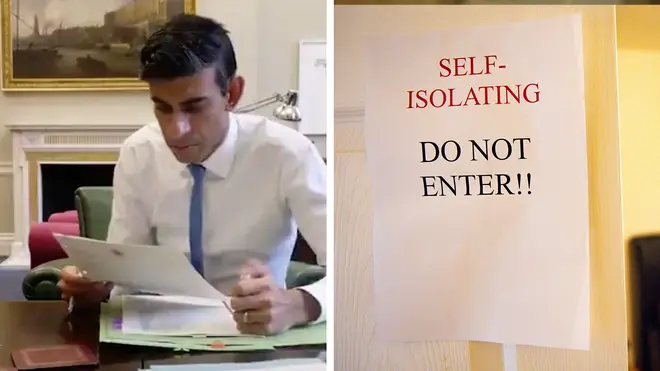

Rishi Sunak is expected to set out measures to limit the economic impact of the Covid-19 outbreak.

He says he's ready to deliver "whatever action is required" to help the NHS and businesses deal with the current public health crisis.

The Chancellor has also promised to invest "historic amounts" on infrastructure and innovation.

But as the number of cases of coronavirus in the UK reached 382 on Tuesday, a daily rise of 63, what are the measures Mr Sunak could use?

The NHS will get "whatever resources it needs"

The Chancellor confirmed the NHS will get "whatever resources it needs" to cope with a coronavirus epidemic.

Speaking ahead of today's Budget, Mr Sunak said the UK's "strong" economic foundations meant he could provide additional funding.

He said: "I can say absolutely, categorically, the NHS will get whatever resources it needs to get us through this crisis."

Help for businesses left out of pocket

Mr Sunak also said he would be setting out plans for extra financial help for businesses if measures against the virus meant they were out of pocket.

There are concerns for businesses such as pubs, restaurants, cinemas and theatres, whose business may be hit by measures to control the virus.

One thing expected is for the Chancellor to provide help for businesses with cashflow problems and help with small business rates.

Easing restrictions on benefits

As well as helping businesses, the Chancellor will look at policies to ease the pressure on individuals who are forced to self-isolate or come down with the illness.

Among the measures he could introduce are ensuring Universal Credit benefits and Employment and Support Allowance are available "quickly and effectively".

He could also announce plans to waive requirements for sick notes or in-person benefits interviews.

Bank of England cuts interest rates

The Bank of England has announced an emergency cut to its main interest rate to respond to the economic shock from the coronavirus outbreak.

It has gone down from 0.75% to 0.25%.

Mortgage holidays

RBS has announced it will allow people affected by the coronavirus outbreak to defer mortgage and loan repayments for up to three months.

TSB and Lloyds said they would also allow a mortgage window, and the banks said savers could close fixed-term savings accounts without charge.

The policy is designed to allow people to access cash if they need it due to being unable to work or forced to self-isolate.