Ben Kentish 10pm - 1am

28 September 2022, 23:21 | Updated: 29 September 2022, 00:40

Kwasi Kwarteng will not rethink his tax-cutting budget despite the Bank of England being forced into a £60billion government debt buy-up to prevent a collapse of pension funds.

In an unprecedented move, the Bank of England stepped in to buy government debt hours in a bid to prevent soaring interest rates leading to the collapse of pension funds.

They were under huge pressure from huge moves in gilts - bonds issued to finance government borrowing - combined with a plunging Pound.

Officials feared they were witnessing a "dynamic run" similar to that seen when Northern Rock failed at the start of the credit crunch 14 years ago.

The Bank's action is designed to add more demand for gilts and and pump up their prices - which in turn brings down the interest rates.

Britain's financial system has been under huge strain since the new Chancellor unveiled a controversial tax-cutting mini-budget last Friday.

But despite signs of Tory nerves Mr Kwarteng's allies were defiant saying there is no prospect of a change in approach.

City minister Andrew Griffith insisted the government was going to "get on and deliver that plan".

Asked whether ministers took responsibility for what was happening in financial markets, he said: "No, we both know that we're seeing the same impact of Putin's war in Ukraine cascading through things like the cost of energy, some of the supply side implications of that.

"And that's impacting every major economy and just the same, every major economy, you're seeing interest rates going up as well.'

He added: "We think they are the right plans because they make our economy competitive. At the end of the day, that is ultimately what we have got to do.

"What politicians are responsible for is making the economic decisions that will drive continued growth. You know that one of the things that has bedevilled our economy is our inability to reach that top 2.5 per cent rate of growth. It has happened in the past, it happened before the 2008 financial crisis.

"We can get back to that, but we are only going to do so, with a programme of supply side reform that was embedded in the growth plan."

On Wednesday, Sterling fell 1.5% against the dollar to $1.05 amid volatile trading, and while the Bank's intervention did calm gilt traders it did not stabilise the pound.

Opposition parties demanded that Parliament be recalled and Tory grandees such as Kenneth Clarke called for a rethink.

The former chancellor told Tonight with Andrew Marr: "I've never known a budget to cause a financial crisis like this, I think the Government and the Bank of England are still going to have to act to calm it down and get us back to normality before we work out how we're going to recover."

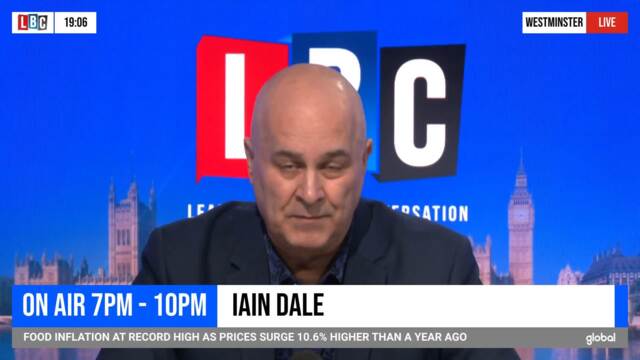

Iain Dale questions Financial Secretary to the Treasury and Tory MP Andrew Griffith

Lord Ken Clarke: I've never known a budget cause a financial crisis like this

Today Mr Kwarteng stepped up efforts to reassure the City about his economic plans after the International Monetary Fund criticised the Government's strategy - and as the pound suffered further falls on Wednesday.

He held a meeting with business leaders, including representatives from Bank of America, JP Morgan, Standard Chartered, Citi, UBS, Morgan Stanley and Bloomberg, which broke up by midday.

Last night government departments were ordered to draw up plans for cuts.

The turmoil has seen some Conservatives attack the Government, including the Tory peer Lord Barwell.

The Bank said: "Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability.

"This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy.

"In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses."

Read More: I've never known a budget cause such a serious and extraordinary crisis, Ken Clarke tells LBC

Read More: Marr: It is a dereliction of duty that Truss and Kwarteng didn't speak today - cowardly and shameful

Its bond-buying programme will run from Wednesday until October 14.

The Treasury responded by reaffirming its commitment to the Bank of England's independence and said the Government "will continue to work closely with the Bank in support of its financial stability and inflation objectives".

Leaving the meeting bank executives did not respond to any questions about what was said during the talks although it is understood Mr Kwarteng "underlined the government's clear commitment to fiscal discipline" and .stressed he is "working closely" with the Bank of England and OBR.