Simon Marks 4pm - 7pm

11 March 2023, 14:43 | Updated: 11 March 2023, 15:53

Brits are struggling to get their money out of an American bank that collapsed into insolvency in the biggest banking failure since 2008.

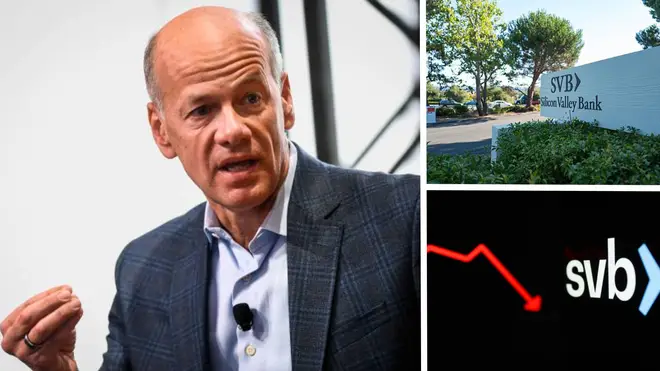

Silicon Valley Bank (SVB) was one of America's biggest financial institutions.

It failed after depositors - mostly technology workers and venture capital-backed companies - began withdrawing their money creating a run on the bank.

Some British companies with money in SVB said they had not been able to get their assets out.

The CEO of a start-up that was unable to withdraw the final £25,000 from its SVB account told the Times: “We made a payment instruction seemingly successful earlier, but funds have not moved and we can’t log in; we are getting error messages.”

The government said on Saturday afternoon that Treasury officials are working with the Bank of England to make sure that Silicon Bank UK’s failure is managed smoothly, and that any disruption is minimised.

The US Federal Deposit Insurance Corporation (FDIC) seized the bank's assets on Friday. The bank had $209 billion (£173 billion) in assets and 175.4 billion dollars (£146 billion) in deposits at the time of failure, the FDIC said in a statement.

The FDIC did not announce a buyer of Silicon Valley's assets, which is typically when there is an orderly wind-down of a bank. The FDIC also seized the bank's assets in the middle of the business day, a sign of how dire the situation had become.

The financial health of Silicon Valley Bank was increasingly in question this week after the bank announced plans to raise up to 1.75 billion dollars (£1.45 billion) in order to strengthen its capital position amid concerns about higher interest rates and the economy.

Shares of SVB Financial Group, the parent company of Silicon Valley Bank, had plummeted nearly 70% before trading was halted before the opening bell on the Nasdaq.

CNBC reported that attempts to raise capital failed and the bank was now looking to sell itself.

Silicon Valley bank was the 16th largest bank in the US. It acts as a major financial conduit for venture capital-backed companies, which have been hit hard in the past 18 months as the US Federal Reserve has raised interest rates and made riskier tech assets less attractive to investors.

UK’s economy returns to growth after rebound in entertainment and transport