Shelagh Fogarty 1pm - 4pm

7 December 2020, 07:36 | Updated: 7 December 2020, 07:45

Britons amassed around £100 billion of "excess savings" during coronavirus lockdowns, according to the Bank of England's chief economist.

Andy Haldane said restrictions on the hospitality sector and non-essential jobs have created “pent-up demand” that could help the economy rebound.

The household saving ratio soared to an all-time high of 29.1% in the second quarter of this year, according to the Office of National Statistics.

This was up from the 9.6% saving ratio in the first three months of the year.

“People are using their involuntarily-accumulated savings on a new house or a new car,” Mr Haldane told the Daily Mail, explaining they are “excess because they weren't planned”.

Read more: Covid-19 crisis in numbers: LBC brings you the stats you need to know

Hundreds queue in Bristol as Primark repoens after lockdown

“Consumer spending has come back at real pace”, he added, “households have shown unbelievable resilience".

“Plenty of that pent-up demand is still in the tank... there are plenty of those savings still to be used.

“You are not going to go to the pub twice as much when they're open again, but there will be some catch-up in social spending. There is plenty of scope there for the vaccine to release more of that pent-up demand.”

Read more: Shoppers flood Britain's high streets on first weekend after lockdown

Keir Starmer urges public to shop local on Small Business Saturday

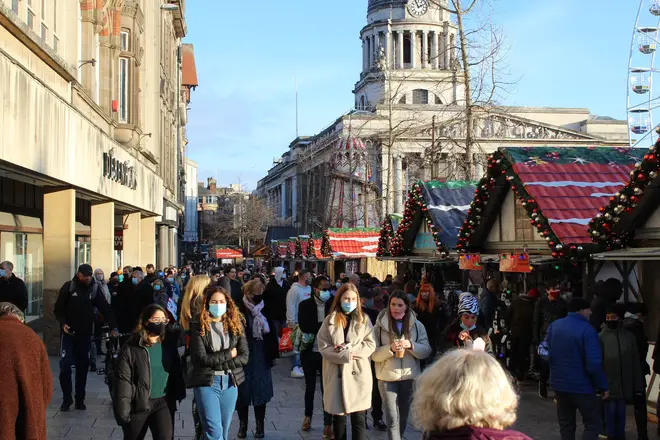

While recent days have seen packed high streets ahead of Christmas, the increase in wealth is not evenly distributed across society.

Figures from the Institute for Fiscal Studies suggest the poorest 20% of households have seen the money in their bank accounts decline an average of £170 per month between March and September.

The IFS report notes “income falls are not fully cancelled out by lower spending” in these groups.

Meanwhile, middle-class families, on average, had an additional £350 a month in their bank accounts across the same period.

Read more: Nottingham Christmas market closed for rest of the year after social distancing criticism

A survey from Fidelity International also found more than three-quarters of people in their 20s had to dip into their savings in the past six months to cover day-to-day costs.

60% of people across all age groups had used savings to cover everyday bills and expenses, with a third "repeatedly relying on their savings".

The survey also found four in five workers surveyed, who had previously been furloughed, said they had needed to access their savings over the past six months.

Read more: Economy slumps by 11.3 per cent, largest fall in 300 years - OBR

Danger of mass pub closures if restrictions aren't eased

Chancellor Rishi Sunak has warned the “economic emergency has only just begun” in the UK.

At his Spending Review, at the end of November, Mr Sunak announced the official forecast for the UK economy predicted it will “contract this year by 11.3%, the largest fall in output for more than 300 years".

Read more: No doubt over safety of Covid vaccine, says head of UK regulator

But last month Mr Haldane took a more upbeat approach, saying the outlook for the UK economy next year was "materially brighter" following developments in vaccines for Covid-19.

In a speech to TheCityUK's conference, Mr Haldane warned there would be "lasting implications" from the pandemic for the UK economy, but added that 2021 prospects were now boosted.

He said: "We all live in hope of the three Rs ... recovery, rebalancing and revitalisation. With the recent positive news about vaccines, that hope is now justified."