Vanessa Feltz 3pm - 6pm

10 August 2023, 06:03 | Updated: 10 August 2023, 06:14

There is fresh relief for homeowners as banks prepare to launch a mortgages rates price war - including the nation's biggest lender.

Halifax plans to cut the cost of its loans by up to 0.71 per cent following major cuts by HSBC, TSB, and Nationwide.

Moves by some of the UK's biggest banks could cause others to follow suit, experts have suggested.

"Halifax is making the single largest rate reduction I have seen from a high street lender," said Jamie Lennox from Dimora Mortgages.

"I expect others to reduce their rates this week, which could start a price war."

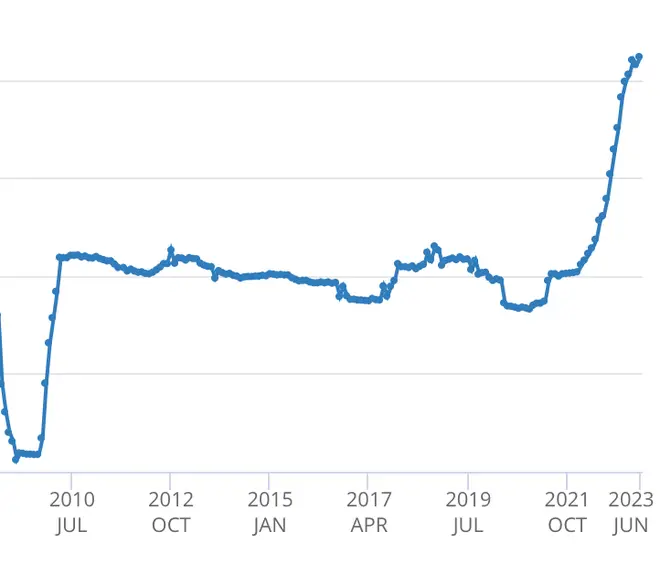

The move gives homeowners hopes that mortgage costs have peaked after significant rises over the last 18 months.

From today, five-year fixed mortgages will drop from 5.99 per cent to 5.28 per cent for borrowers who have 40 per cent equity.

Two-year deals have been slashed by 0.27 per cent. Meanwhile, prospective buyers with a 20 per cent deposit will pay 6.18 per cent.

Read More: It would be 'manifestly unfair' to use taxpayers' money to subsidise mortgages, Tom Swarbrick says

Read More: Rishi Sunak tells homeowner facing £2,700 monthly mortgage repayments: 'Talk to your bank'

The UK's second-biggest lender, Nationwide, has reduced the cost of some fixed-rate deals by 0.55 per cent, while HSBC has made cuts of up to 0.35 per cent.

TSB also announced price reductions of up to 0.4 per cent.

The average two-year deal sits at 6.83 per cent, while five-year rates sit at 6.34 per cent, MoneyfactsCompare data suggests.

Rishi Sunak was taking calls from LBC listeners last week and he said he’s “determined… to bring inflation down to everyone.”

But the Bank of England hiked from 5 per cent to 5.25 per cent last week - in yet another blow for struggling families.

“Families are struggling with the cost of living - it’s not as fast as I would like but we are heading in the right direction. Inflation is coming down," Mr Sunak said.

Mr Sunak highlighted ‘easements’ put in place by the government, adding: “We don’t want people to lose their homes.”

Giving advice to a struggling homeowner, Jack - who said he feels like he is being ‘punished’ for paying into the system all his life, Mr Sunak said he should “talk to your bank.”

Jack said he is facing a rise from £1,500 to £2,800 a month in mortgage repayments and asked: “Why do I feel like I’m being unfairly punished?”