Rachel Johnson 7pm - 10pm

3 August 2023, 12:03 | Updated: 3 August 2023, 15:38

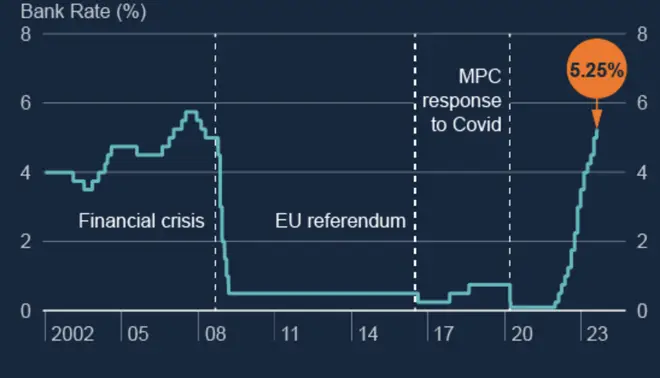

The Bank of England has put up the UK interest rate for the 14th time in a row - this time by 0.25% to 5.25%.

The change will add to mortgage woe for families across the country, who will end up paying more as their terms come up for renewal.

The effort to control inflation will put more pressure on mortgage holders but Deputy PM Oliver Dowden told LBC this morning: “I know how very difficult it is for people facing rising interest rates.

“The quicker we can get inflation under control the smaller the interest rate rises will have to be.”

Bank of England Governor Andrew Bailey said that pay has increased a lot more than the Bank expected just three months ago.

Andrew Bailey said that it is not "time to declare it's all over" after the Bank hiked interest rates for the 14th time in a row.

"We've had quite contrasting evidence in the last couple of months or so.

"The evidence has gone one way then gone a bit the other way.

"So I don't think it is time to declare it's all over and we're sort of sticking where we are for the moment, because I think that really does sit at odds with the fact that we've had some very big pieces of news and they are not going the same direction.

"So I think we have to remain evidence driven. We've continued to use language which we've used before, which is to say, if we get more evidence of more persistent inflation then we will have to react to that."

"We do recognise, and I think it's very important to say, that inflation has a very serious effect particularly on those least well off."

"The main components of inflation, energy and food, make up a bigger portion of spending for lower income families," he said.

"But I will emphasise that the economy is more resilient. Yes unemployment has gone up a bit, but it is still at historically low levels.

"We haven't experienced a recession and we're not forecasting one."

He added that the Bank's use of the word "restrictive" to describe the path for interest rates applies in that context.

Chancellor Jeremy Hunt said: "If we stick to the plan, the bank forecasts inflation will be below 3% in a year's time without the economy falling into a recession.

"But that doesn't mean it's easy for families facing higher mortgage bills so we will continue to do what we can to help households."

Shadow chancellor Rachel Reeves said: "This latest rise in interest rates will be incredibly worrying for households across Britain already struggling to make ends meet.

"The Tory mortgage bombshell is hitting families hard, with a typical mortgage holder now paying an extra £220 a month when they go to re-mortgage.

"Responsibility for this crisis lies at the door of the Conservatives that crashed the economy and left working people worse off, with higher mortgages, higher food bills and higher taxes."

The last time rates stood at at 5.25% was in March 2008.

UK inflation is expected to drop below 5% in the final few months of 2023, allowing the Prime Minister to meet his target of halving inflation by the end of the year, according to new projections from the Bank of England.

The Bank predicted that Consumer Prices Index (CPI) inflation will fall to 4.9% in the final quarter and remain above 2% until mid-2025.

The recent easing of price rises has been driven largely by a fall in international energy prices, which are set to reduce the average UK household's energy bill to below £2,000 a year by October.

The Bank added in its report: "Food price inflation, which has a particularly large impact on the living costs of lower-income families due to it making up a larger share of these families' budgets, remains extremely high."

House prices fell at the fastest annual rate in 14 years in July, as housing affordability has been stretched for people looking to buy a home with a mortgage, Nationwide said.

The slowing market has had a knock-on effect on a number of housebuilders and builders' merchants who have flagged much weaker demand for properties.

Furthermore, growth in Britain's services sector slowed last month, as concerns over interest rates and the economic outlook took a toll on consumer demand, S&P Global said in its PMI survey.

But the rise in cost of living in London shows no sign of abating, with average rents in the capital predicted to surge as high as £2,700 per month by next year.

The MPC will produce new forecasts on the path for inflation and gross domestic product (GDP) along with its rates decision on Thursday.

It will shine a light on how likely the Prime Minister is to meet his target of halving inflation to about 5% by the end of the year.

Rishi Sunak said on Wednesday that inflation is not falling as fast as he would like, but that people can "see light at the end of the tunnel".

Meanwhile, banks are under more pressure to pass rate rises onto savers.

Myron Jobson, senior personal finance analyst for Interactive Investor, said: "There might be a bit more urgency among banks and building societies to pass on the base rate rise to their savings products this time around as the Financial Conduct Authority (FCA) has recently gained new powers to take robust actions against those offering unjustifiably low rates."

The FCA this week shared a 14-point action plan to make sure that savers are being offered better deals.