Henry Riley 4am - 7am

28 September 2022, 11:21 | Updated: 28 September 2022, 17:29

Liz Truss's economic policies are the "right plan", a minister has insisted, despite the pound slumping and the Bank of England having to intervene to save pensions.

They would have collapsed today without any action from the Bank of England, Sky News reported.

The Bank of England was forced to step in with a £60million buy-up of government debt to stop a collapse in the funds.

It emerged that the intervention was triggered that fears the whole system would have been at risk. Sir Keir Starmer, the Labour leader, accused Liz Truss of being a "danger" who had "lost control".

But Andrew Griffith, the city minister, said after that the Government still believes the Kwasi Kwarteng's big tax-cutting policies, announced on Friday, were correct.

"We think they are the right plans because those plans make our economy competitive," he said, declaring the Government was focused on "supply-side" reforms that would deliver yearly economic growth of 2.5%.

He added: "Get on and deliver that plan. That's what I, the Chancellor and my colleagues in Government are focused on is getting on and delivering that growth.

"That is what is going to allow consumers to benefit. In the meantime, we are protecting every household and every business from the biggest macro shock out there at the moment, which is the cost of energy."

He added that all developed economies were experiencing volatility.

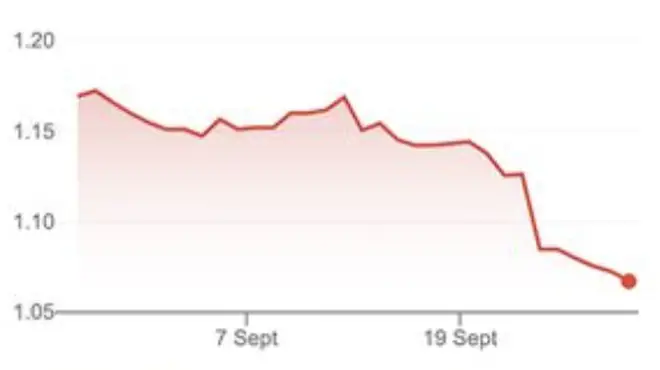

The pound continued to fall despite the Bank of England's intervention to buy Government debt and stop borrowing costs spiralling out of control.

The Bank has launched an emergency UK Government bond-buying programme to stave off a "material risk to UK financial stability".

It said it will buy Government bonds - known as gilts - at an "urgent pace" after fears over the Government's economic policies sent the pound tumbling and sparked a sell-off in the gilts market.

While the pound hit an all-time record low of 1.03 against the US dollar on Monday, the yield on 10-year gilts - which is a proxy for the effective interest rate on public borrowing - has soared by the most in a five-year period since 1976, according to experts.

On Wednesday, Sterling fell 1.5% against the dollar to $1.05 amid volatile trading, and while the Bank's intervention did calm gilt traders it did not stabilise the pound. Opposition parties demanded that Parliament be recalled.

Read more: Food inflation at record high as prices surge 10.6% higher than a year ago

It follows the financial turbulence that came in the wake of Chancellor Kwasi Kwarteng's mini-budget on Friday, with the pound tumbling and banks withdrawing a record number of mortgage products after a steep hike in gilt yields.

He cut a series of taxes, including abolishing the top rate of income tax, but it was criticised for the number of giveaways and shredding sources of revenue.

The turmoil has seen some Conservatives attack the Government, including the Tory peer Lord Barwell.

The Bank said: "Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability.

"This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy.

"In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses."

Its bond-buying programme will run from Wednesday until October 14.

The Treasury responded by reaffirming its commitment to the Bank of England's independence and said the Government "will continue to work closely with the Bank in support of its financial stability and inflation objectives".

It comes as Mr Kwarteng stepped up efforts to reassure the City about his economic plans after the International Monetary Fund criticised the Government's strategy - and as the pound suffered further falls on Wednesday.

He held a meeting with business leaders, including representatives from Bank of America, JP Morgan, Standard Chartered, Citi, UBS, Morgan Stanley and Bloomberg, which broke up by midday.

Read more: Rishi Sunak will not attend the Conservative party conference

Executives from major banks left the Treasury but did not respond to questions about any assurances they had been given by Mr Kwarteng.

Banks are moving to try and stop their deals becoming to cheap compared to rivals so are withdrawing mortgage products to re-price them, and protect against a surge in demand if the price dips very low.

Sir Keir called for MPs to return to Westminster and Parliament to be recalled so Mr Kwarteng could change his strategy "before any more damage is done".

Shadow chancellor Rachel Reeves said: "People will be deeply worried about the impact of this turmoil on their mortgage, their pension, and their cost of living.

"This is a crisis made in No 10 and is the direct result of the Tory Government's reckless actions, which include tax cuts for the richest 1%."