Tom Swarbrick 4pm - 7pm

1 February 2024, 12:19 | Updated: 1 February 2024, 15:12

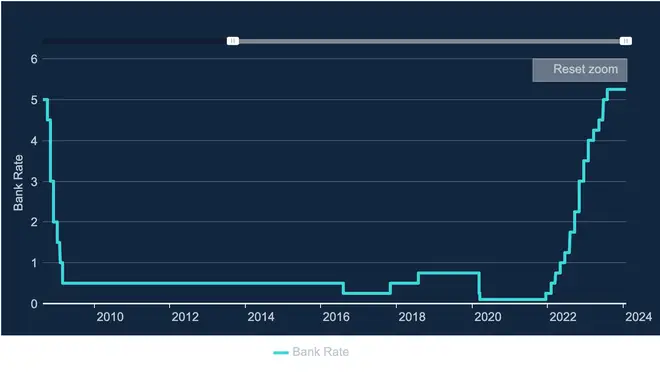

Interest rates have been held at 5.25% again by the Bank of England - despite hopes they would come down as inflation lowers.

It is the fourth time the Bank has kept rates the same, halting 14 increases in a row to bring down soaring price rises.

The target is bringing inflation to 2% - and it stands at 4% having risen as high as 11.1% in October 2022.

Mortgage holders are hoping interest rate cuts are on the way soon.

But Bank governor Andrew Bailey said there needed to be more evidence that inflation will stick around 2% before slashing rates.

Read more: UK inflation rate sees surprise increase after rises in tobacco and alcohol prices

"Today we've decided to hold interest rates at 5.25%. We have had good news on inflation over the past few months," he said.

"It has fallen a long way, from 10% a year ago to 4%. But we need to see more evidence that inflation is set to fall all the way to the 2% target, and stay there, before we can lower interest rates."

The Bank said on Thursday that inflation could come back down to 2% in the second quarter of this year, but will rise slightly in the third and fourth quarters.

It said this is down to "domestic inflationary pressures", which will see 2.3% inflation in two years' time then 1.9% in three.

Interest rates are agreed upon at a vote by the Bank's Monetary Policy Committee (MPC). A total of six members voted to keep rates at 5.25%, while two wanted it to rise to 5.5% and one wanted it brought down to 5%.

Swati Dhingra voted to cut interest rates because inflation is on "a firm downward trajectory" and feared rates would be slashed too late.

Read more: Jeremy Hunt casts doubt on big tax cuts in spring Budget after warning from IMF

A statement from the Bank said: "Since the MPC’s previous meeting, global GDP growth has remained subdued, although activity continues to be stronger in the United States.

"Inflationary pressures are abating across the euro area and United States. Wholesale energy prices have fallen significantly.

"Material risks remain from developments in the Middle East and from disruption to shipping through the Red Sea."

It added that the labour market remains tight by past standards, and that while services price inflation and wage growth have fallen - helping to bring down economic overheating - "key indicators of inflation persistence remain elevated".

This means "monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term".

The Bank has also said the economy is likely to have done worse last year than originally thorugh - with GDP increasing by 0.25% instead of the 0.5% predicted in November.

However, growth this year is now expected to be 0.25% instead of 0%.

GDP is also forecast to grow 0.75% next year, instead of 0.25%, and 1% in 2026 instead of 0.75%.