James O'Brien 10am - 1pm

7 November 2024, 18:03 | Updated: 7 November 2024, 18:22

The Governor of the Bank of England has warned that trade tariffs proposed by Donald Trump could cause a "fracturing" of the global economy.

Andrew Bailey told LBC's Tonight with Andrew Marr that protectionism is "not a good thing" as free trade stimulates growth.

Mr Trump promised before his re-election that he would impose tariffs of between 10% and 20% on all goods imported into the US - a tactic designed to boost American companies and the country's economy.

Some economists have suggested that tariffs could significantly slow the growth of the global economy, including the UK.

It's unclear exactly how Mr Trump will go about imposing tariffs, a point that Mr Bailey pointed out to Andrew. "We need to reserve judgement on that until we see what happens," he said.

Read more: Interest rate cut to 4.75% - marking just the second reduction in almost four years

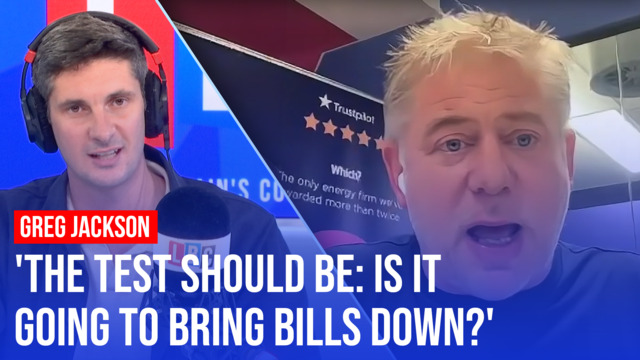

CEO of Octopus Energy on what Donald Trump's victory could mean for energy and climate policy

But the Bank of England governor said that Mr Trump putting trade barriers up that would drive the "fragmentation of the world economy".

Explaining his analysis, he said: "First of all, open trade really stimulates growth. I mean, Adam Smith taught us this, open trade is good for growth. Now, there are risks attached to it, and we have seen those risks. So there are obviously risks."

Mr Bailey said those risks were on display with the war in Ukraine - "that if you're overly dependent on one part of the world for something... if it gets disrupted, that can have a bad effect."

"So diversification... spreading, your sources of things, and trade is sensible and good.

"But if the world becomes more closed, cost of trade goes up, protectionism, that's not a good thing."

Kamala Harris makes phone gaffe on election night

Mr Bailey was speaking after the Bank of England's monetary policy committee voted to cut the base rate to 4.75% from 5% on Wednesday.

He said that inflation would increase following Labour's Budget, but in a "very small" way compared to the large spike of recent years. "we expect it to come back down to our target of 2%," he added.

Mr Bailey said: "There were two things that really led me to think today was the right day to do another cut in rates.

"First of all, we've actually had very good news on the way inflation has come down. It's below where we thought it would be, so we're starting at a lower level.

"And secondly, yes, we think it will go up a bit, but it's going to come back down to targets, and that gives us the confidence to cut rates now, and it's the right thing to do."