Natasha Devon 7pm - 10pm

13 October 2022, 00:45 | Updated: 13 October 2022, 06:30

Senior advisers have turned on Liz Truss after she pledged to not reduce public spending.

The Prime Minister's leadership was in renewed peril on Wednesday evening as she was accused of "trashing the last 10 years" of the Tories' record at a bruising meeting with backbenchers.

Some of the PM's most senior advisers told her she needs to rip up the latest mini-budget and raise corporation tax to restore market confidence in her government.

Officials warned that it is "no longer credible" to keep pushing on with big tax cuts without risking a financial crisis that would further drive up government borrowing and mortgages.

Despite Downing Street insisting the tax cuts will go ahead, one government source said privately "that could change" after the PM ruled out a reduction to public spending.

A senior government source told The Times that the advice from senior civil servants was that the government’s position was no longer credible and "won’t hold".

Another confirmed that Ms Truss was aware of officials’ views but stressed "no final decision" had been made before Chancellor Kwasi Kwarteng's financial statement on October 31.

'People don't just want a new Prime minister, they want a new government.'

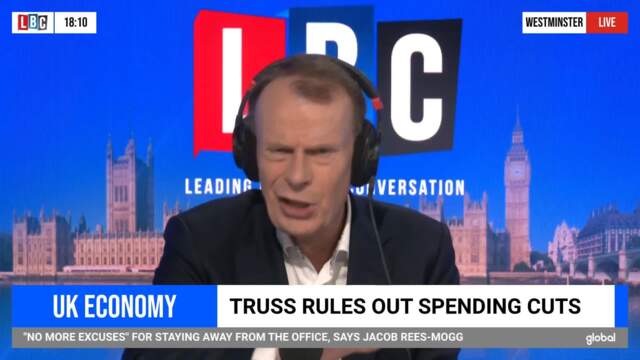

It comes after Ms Truss insisted during PMQs on Wednesday that she will stick to her pledge not to reduce public spending.

"We're spending almost £1 trillion on public spending. We were spending £700 billion back in 2010," she said.

"What we will make sure is that over the medium-term the debt is falling.

"We will do that, not by cutting public spending, but by making sure we spend public money well."

'It would be very difficult to find those cuts and politically I think it's completely impossible.'

Senior Tories have joined calls for a rethink, with the chairman of the Treasury select committee among those insisting a fresh package be brought forward that will "actually satisfy the markets".

Mel Stride warned: "The Chancellor will only get one opportunity to land his plans and the forecast positively.

"He must take no chances. There is too much at stake for all of us."

Meanwhile, Sajid Javid recommended either the tax cuts or the energy price freeze be scaled back in order to balance the books.

He said plans had gone "way beyond" what the markets were expecting and reassurance was needed.

Damian Green added that a tax cuts u-turn was an option being discussed by many in the Commons, saying: "The government’s policy has to be credible, as we have all discovered, with the markets, and I think that may well involve some changes to government policy."

'The bank can only do so much!'

As MPs openly discussed the prospect of ousting the Prime Minister, an attempt to win over mutinous MPs at a meeting of the Tory backbench 1922 Committee on Wednesday evening failed.

Addressing the group, Ms Truss said small businesses would have faced "devastation" if the Government had not acted to cap energy prices, according to aides.

But she was met with open criticism, with MPs reportedly raising concerns about soaring mortgage rates and the Tories' slump in the polls.

Commons education committee chair Robert Halfon told Ms Truss she had "trashed the last 10 years of workers' Conservatism".

The Prime Minister and Chancellor are expected to meet with critical MPs from next week to try to assure them that Mr Kwarteng's medium-term fiscal plan on October 31 will address their concerns.

Since Mr Kwarteng's September 23 mini-budget, the value of sterling has fluctuated and yields on government bonds, the cost of state borrowing, rose to such an extent that the Bank of England was forced to intervene to prevent problems for pension funds.

Economists have suggested that restoring confidence in the Government's grip on the national finances will require tens of billions of pounds' worth of spending cuts or tax rises.