Ian Payne 4am - 7am

9 April 2020, 13:14 | Updated: 7 June 2023, 08:56

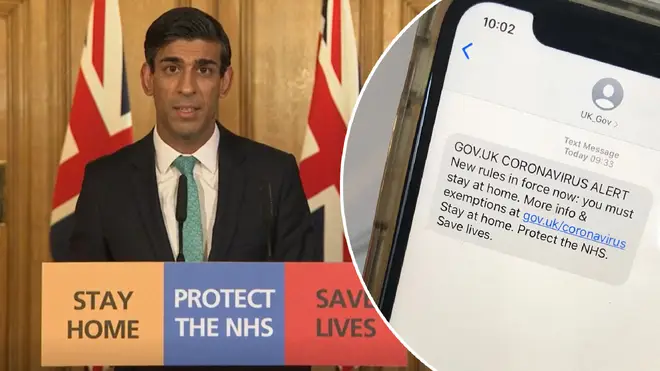

Rishi Sunak announces self-employed income support scheme

Thousands of businesses impacted by coronavirus are putting some employees on furlough this week. So what is furlough and how can people claim for it?

Chancellor Rishi Sunak announced that the government would pay 80% of the wages of furloughed workers, up to a limit of £2,500 per month after the impact of coronavirus on jobs.

So what does it mean? And how can people claim on the government scheme for furlough?

When a company doesn't have work for its workers for a period of time, they can put them on a temporary leave, called a furlough.

In this instance, employers are putting workers on furlough if their work has been forced to close due to the coronavirus pandemic.

The government will support that workers during this time with a zero cost to the company - although they can choose to top up the wages to a full 100% if they wish. The aim is to avoid mass redundancies during the UK lockdown.

READ MORE: What are the symptoms of coronavirus and when should you self-isolate?

READ MORE: What are the rules of the UK's coronavirus lockdown?

The Coronavirus Job Retention Scheme is a temporary scheme open to all UK employers for at least three months starting from 1 March 2020. It is designed to support employers whose operations have been severely affected by coronavirus (COVID-19).

Employers can use a portal to claim for 80% of furloughed employees’ usual monthly wage costs, up to £2,500 a month, plus the associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on that wage. Employers can use this scheme anytime during this period.

The scheme is open to all UK employers that had created and started a PAYE payroll scheme on 28 February 2020.

The online portal is expected to be available by the end of April.

Martin Lewis answers most popular money questions around coronavirus

MoneySavingExpert founder Martin Lewis encouraged all employers to use the furlough scheme rather than laying people off.

Speaking to LBC, he said: "If employers have workers who don't have work to do, they can put them on furlough, which is like putting them on standby, then the government will pay 80% of their salary up to £2,500 per month. The employer doesn't have to add on to that, although it can if it wants to.

"The state will also give the employer the National Insurance contributions and the minimum pension contributions on top, so there is zero cost to the employer.

"My big issue with this is that many employers are not putting staff on furlough, they are making them redundant or giving them unpaid leave because they may think furlough is cheating the system. That's the wrong way around.

"Here is a list of things you are allowed to furlough for:

- Staff who have no work

- Staff who can't work because they need 12-weeks self-isolation

- Staff who can't work because they must be home for the kids

- Staff with variable incomes, zero-hours contracts or agency workers

"And most importantly, you can re-hire staff who were on your payroll on 28th February - even if they left voluntarily, you can bring them back and furlough them.

"My recommendation to employers: if you can furlough, furlough."

The website to claim furlough payments is not available yet, but the Government expects it to be available by the end of April.

You can only submit one claim at least every three weeks, which is the minimum length an employee can be furloughed for. Claims can be backdated until March 1st.

If you are a self-employed company director and pay yourself a salary by PAYE, then you can use the furlough system, but you will not get help on dividends you are usually paid.

Martin Lewis explains: "This is for people who are sole-employee limited company directors, who pay themselves a small salary by PAYE and top that up with dividends. There is no support for dividends.

"The only option you have if you are not working is to furlough yourself as an employee - which is allowed. While this means you wouldn't be allowed to work, I've had confirmation that you are still allowed to complete your statutory obligations as a company director, such as filings."