Richard Spurr 1am - 4am

30 October 2020, 08:34

Banknote maker De La Rue has been making the plastic cash for the central Bank since 2015.

The Bank of England has extended a contract with banknote maker De La Rue to keep making the bank’s cash for three years beyond its original 10-year contract, the company has announced.

De La Rue started making the central Bank’s first polymer notes in 2015, launching England’s first plastic £5 note a year later.

The contract had been due to end in 2025 but a three-year extension clause has been triggered, the bank said.

Notes will be printed at the bank’s facility in Debden, Essex, and comes as De La Rue announced a £15 million investment in its polymer production in June this year.

Sarah John, Bank of England chief cashier, whose signature appears on every banknote, said: “The relationship with De La Rue is an important one for the Bank of England.

“During the course of the current contract, we have worked closely together to launch three new banknote designs on polymer.

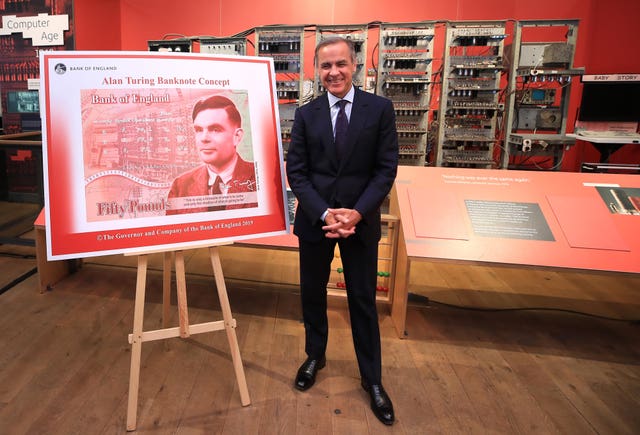

“In 2021, the release of the new Alan Turing £50 note will complete our polymer set.

“We are very pleased to announce the extension of the contract today, which will enable us to continue to develop our Debden facility as a global centre of excellence for banknote printing.”

It remains unclear how many notes will be needed longer-term, with the coronavirus pandemic seeing a huge shift towards a cashless society.

But De La Rue has previously said the notes are cleaner and less likely to transmit viruses compared with traditional paper notes.

Clive Vacher, chief executive of De La Rue, said: “We are delighted that our contract with the Bank of England has been extended to 2028, highlighting De La Rue’s commitment to UK manufacturing.”

Relations between the company and the UK Government were strained in 2018 when it lost out on the new post-Brexit passport contract.

Bosses threatened court action over the decision, but, this was subsequently dropped and the company sold its passport division.

A Serious Fraud Office (SFO) also loomed over the company with allegations of fraud at its South Sudan business, although this was dropped after investigators said the evidence did not “did not meet the relevant test for prosecution”.