Richard Spurr 1am - 4am

20 September 2021, 14:14

Foreign Office minister James Cleverly said the Government would prefer that companies stay afloat ‘organically’.

The Government wants energy firms to “stay afloat organically”, a Cabinet minister has said, as the growing energy crisis led to company bosses saying the outlook was “looking bleak”.

Wholesale prices for gas have surged 250% since January, with a 70% rise since August alone – leading to calls for support from the industry and the collapse of some smaller energy firms.

Business Secretary Kwasi Kwarteng held a fresh round of crisis talks with the industry on Monday amid fears more small suppliers could go to the wall.

Following the talks he said ministers were “looking at options to protect consumers”.

In a series of tweets he said: “In any scenario, we will ensure UK consumers have continuity of supply – through a supplier of last resort or a special administrator if needed.”

Mr Kwarteng previously said consumers would be protected from sudden price hikes through the Government’s energy price cap, and he confirmed this would stay in place.

However, that puts pressure on the suppliers – particularly smaller companies – who are unable to pass on the increases in wholesale gas prices to their customers.

No 10 said there were currently no proposed changes to the energy price cap.

A spokesman for the Prime Minister said: “The price cap remains in place, as I say, to protect consumers from sudden increases in global gas prices and it will save them money this winter.”

Pushed on whether the cap could change between October and the next review date in April 2022, he added: “I’m not aware of any proposed change to the price cap.”

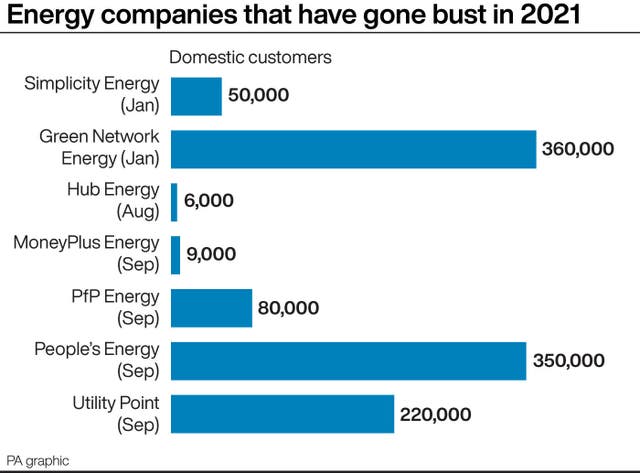

Four firms have already folded and there are fears that more could follow.

On Monday, regulator Ofgem said British Gas would take over the 350,000 domestic customers who had been supplied by People’s Energy before it went bust earlier this month.

Some analysts have reportedly predicted that the UK’s energy companies could be reduced to three-quarters over the coming months, leaving as few as 10.

Tomorrow I will host a roundtable with the energy industry and consumer groups, followed by a number of meetings with colleagues across Government.

Read more about the wider situation affecting Europe, including the UK, as well as other countries 👇🏿 https://t.co/tmgQtzy0Xe

— Kwasi Kwarteng (@KwasiKwarteng) September 19, 2021

On Monday, Peter McGirr, chief executive of small energy firm Green, said “the outlook is looking bleak”.

He said: “I feel that without any support mechanism being put in place by Government, it’s unlikely we will see the winter through.”

But Foreign Office minister James Cleverly said he was “not going to speculate” over whether the Government would step in.

Pushed on whether he was therefore not ruling out the Government bailing out firms, he added: “We are considering a range of options.”

But he said the Government wanted energy firms to “stay afloat organically”.

Asked whether the Government would consider scrapping green levies to bring down bills, No 10 said they were an important part of reducing carbon emissions.

And asked whether the Government would provide state-backed loans to companies, a spokesman for the Prime Minister said: “I can’t pre-empt the outcome of the business roundtable which Kwasi Kwarteng is chairing now.”

The rise in gas prices has been blamed on a number of factors, including a cold winter which left stocks depleted, high demand for liquefied natural gas from Asia and a reduction in supplies from Russia.

Mr Cleverly said the shortage was due to the pandemic, and told Good Morning Britain: “Because the global economy is kind of waking up from this hiatus imposed upon us by Covid, we’re suddenly seeing a surge in demand, and therefore surging gas prices that has affected all kinds of parts of the economy, it has had an impact on food production and we are looking to ensure that we protect those food suppliers.”

However Emma Pinchbeck, head of Energy UK, a trade association for the energy industry, told Times Radio the issue could not be blamed on one factor.

And Kateryna Filippenko, principal analyst at Wood Mackenzie – an Edinburgh-based oil and gas research company – said: “Covid has played a role but it’s more complicated than that. I would definitely not say this was the main reason.”

Speaking to broadcasters on the tarmac of New York’s JFK airport overnight, Prime Minister Boris Johnson said: “This is really a function of the world economy waking up after Covid.

“We’ve got to try and fix it as fast as we can, make sure we have the supplies we want, make sure we don’t allow the companies we rely on to go under. We’ll have to do everything we can.

“But this will get better as the market starts to sort itself out, as the world economy gets back on its feet.”

At the same time, ministers are grappling with warnings of potential shortages on the shelves as the knock-on effect of the gas price rise ripples through the economy.

Producers have warned that supplies of meat, poultry and fizzy drinks could all be hit due to a shortage of carbon dioxide (CO2).

It follows the shutting down of two large fertiliser plants in Teesside and Cheshire – which produce CO2 as a by-product – with the owners citing the increase in gas prices.

On Sunday, Mr Kwarteng met with Tony Will, the global chief executive of CF Industries, the UK’s biggest supplier of CO2 and the owner of the two fertiliser plants.

Nick Allen, chief executive of the British Meat Processors Association, has said the country could be two weeks away from British meat disappearing from supermarket shelves due to the shortage.

But No 10 insisted the UK food chain was “incredibly resilient”.

A spokesman for the Prime Minister said: “We have an incredibly resilient supply chain when it comes to food and we’re well prepared to handle any potential disruptions.”