Clive Bull 1am - 4am

3 May 2022, 11:54

A pensioner could end up losing around £7,000 over their future lifetime, according to calculations from XPS Pensions Group.

Some pensioners on final salary deals could be in for a nasty surprise as surging living costs outpace rises in their incomes, experts have warned.

While many private sector defined benefit (DB) pensions increase in line with inflation, often this is subject to an annual cap, commonly set at 5%, XPS Pensions Group said. With inflation rising above the caps, pensions will lag behind.

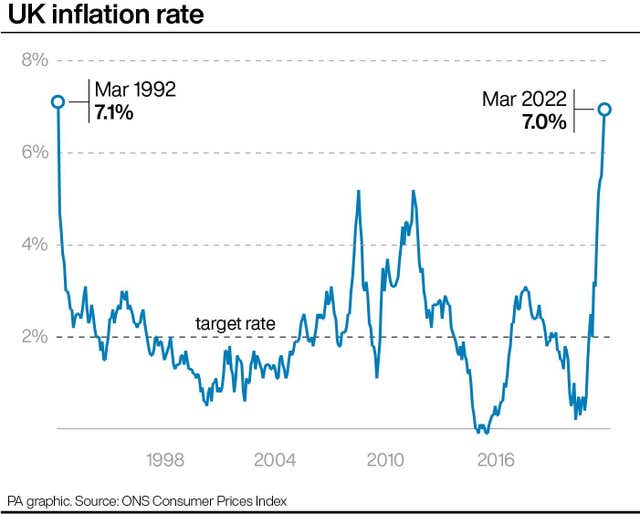

The Consumer Prices Index (CPI) rose by 7% in the 12 months to March 2022, and the figure is expected to climb higher in the coming months.

Steve Leake, a partner at XPS Pensions Group, said: “Private sector DB pension benefits often increase in line with inflation but a lot of increases are capped at 5%.

“If inflation were to reach 10% this year – which isn’t out of the question – our modelling suggests that UK pensioners would collectively lose £1.7 billion in pension benefits in real terms, which works out to about £400 a year for the average retiree.”

A pensioner could end up losing around £7,000 over their future lifetime, although on the other hand the caps could mean UK DB schemes are protected from an additional £30 billion of liabilities, according to the calculations.

Some DB schemes may come under pressure from members to award discretionary increases in excess of the rules, XPS suggested. Its DB:UK funding watch monitors the deficit and funding level of UK DB pension schemes.

Sir Steve Webb, a former pensions minister who is now a partner at LCP (Lane Clark & Peacock), said: “Many people will not be aware that there is a limit to how much inflation protection their company pension scheme will provide.

“The exact limit depends on the individual scheme, but many workers will find that their next pension increase falls significantly short of the rising cost of living.

“This suggests that the squeeze on living standards which many are facing will run well into 2023 and will not be a temporary phenomenon.”

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said: “The cap on inflationary pension increases is going to come as a nasty surprise to those in defined benefit schemes that are subject to a cap.

“It’s such a long time since we saw inflation at this level that a below-inflation increase will come as a shock to the system.”

Ms Coles continued: “Last time we were in this position, pension trustees decided to use their discretion and pay over the cap anyway, because at the time so many were running a funding surplus.

“Now, most are in deficit, so it’s highly unlikely they will do this. They’re far more likely to see this as an opportunity to try to improve their funding position slightly.

“But in the grand scheme of things, this is far less of a problem than the one facing people with defined contribution (DC) schemes who bought a level annuity.

“They will be looking on in envy at the DB schemes where increases are capped at 5%.

“They have no inflation built into their pension payments at all, so some of them will really be struggling with the runaway rise in the price of essentials.”

Phil Brown, director of policy at B&CE, provider of the People’s Pension, also highlighted issues facing people with DC pension pots, which can be used flexibly under the pension freedoms.

He said: “The-cost-of-living crisis and the fall in equity markets represent a major challenge for the pension freedoms, which were introduced in 2015.

“With many people now self-managing drawdown, retirees face a difficult choice between drawing down more in order to preserve their current standard of living and trying to preserve their defined contribution pension fund in the face of falling markets.

“There is a risk that decisions that DC retirees take now may do irrecoverable harm to their financial health. People may dramatically shorten the number of years their DC pension will last in retirement, meaning that they should consider seeking advice or guidance where they can, before making significant changes to their retirement plans.”