James O'Brien 10am - 1pm

16 December 2021, 13:54

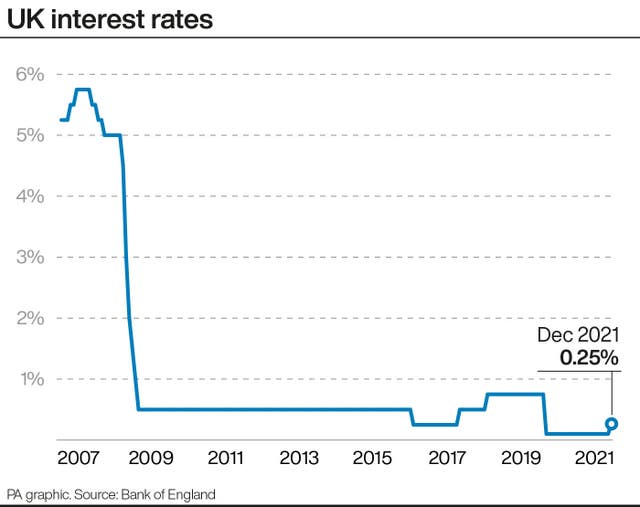

The Bank of England base rate increase, taking it to 0.25%, comes at a time when fuel, food and energy bills are surging.

Households should expect less cheap credit and a period of belt-tightening as overstretched budgets are drained, according to some experts.

They made the warning as the Bank of England announced a 0.15 percentage point increase to the base rate, taking it to 0.25%.

The move will have an immediate impact on households on variable mortgage deals which directly track the base rate.

Borrowers on standard variable rate (SVRs) deals may also see their costs go up, although SVR rates are set by lenders individually.

Around 850,000 mortgage borrowers have a tracker rate mortgage, according to trade association UK Finance, which estimates the 0.15 point increase will lead to a typical £15.45-per-month increase in repayments.

For those who are on an SVR – approximately 1.1 million mortgage borrowers – this rise translates to an estimated increase of £9.58 a month on average.

Many homeowners, however, are locked into fixed-rate mortgage deals and will be cushioned from the immediate impact of the base rate rise.

Around three-quarters (74%) of mortgages are fixed rate, UK Finance’s figures show. It said 96% of homeowner mortgages handed out since 2019 have been on fixed rates, with the majority opting for two or five-year deals.

Charles Roe, director of mortgages at UK Finance, said: “Today’s interest rate increase marks a rise from historically low levels. Over 74% of mortgage customers are on a fixed rate product and will see no immediate change to their mortgage payments.

“For those who have come to the end of their deal, a wide range of mortgage products are available and we encourage homeowners to shop around and choose the best one for their circumstances.

“Any customers with concerns about managing their mortgage should contact their lender who will be able to explore the range of individual support options available.”

Paul Broadhead, head of mortgage and housing policy at the Building Societies Association, added: “Lenders are sensitive to the rising number of people facing a squeezed household budget and the advice to anyone worried about their ability to pay their mortgage is to get in touch with their lender early. Lenders will do everything possible to help.”

The extra costs for some borrowers comes as living costs are surging, with inflation hitting 5.1% in November, its highest level for more than a decade.

Andrew Hagger, a personal finance expert from Moneycomms.co.uk, said: “The uplift in the bank rate may seem small in isolation, but on top of already soaring fuel, energy and food costs, it will be a further drain on many overstretched household budgets.

“The bad news is that this is likely to be the first in a series of rate hikes in 2022 and coupled with higher council tax bills and a significant rise in the energy price cap in the spring, will simply add to the widespread financial misery.”

Ed Monk, associate director at Fidelity International, warned: “A rise in UK borrowing costs won’t ease up clogged supply chains or lower shipping costs.

“The signal today’s rate rise sends is that we should expect a period of belt-tightening and less cheap credit from here on out.”

Andrew Montlake from broker Coreco said that while many people may have been caught “off guard” by Thursday’s decision: “The reality is that this increase has already been priced in so will have little effect on mortgage products available now.

“The real question is whether this is the start of a trend across the next 12 months and just how tough the Bank are prepared to get.

“I expect to see an increased clamour for borrowers to fix in where they can, with many worried having not experienced an increasing rate environment before.”

Rachel Springall, a finance expert at Moneyfacts.co.uk, said competition in the mortgage market has been “rife” this year – and some borrowers may find they can make savings by moving off a variable rate on to a fixed deal.

While some borrowers’ costs will go up, savers will be hoping the base rate rise will bring them better deals.

But Ms Springall cautioned: “This base rate change may take a few months to trickle down to savers who have a variable rate deal, but there is also no guarantee the rate will be passed on to them in full, or at all.”

Looking at the eroding impact of inflation on households’ savings, website SavingsChampion.co.uk calculated that a £50,000 deposit left sitting in a high street bank account earning 0.01% could be worth around £11,000 less in real terms after five years, based on the current inflation rate.

Anna Bowes, co-founder of SavingsChampion.co.uk, said savings rates tend to fall by more when the base rate is cut and rise by less when the base rate increases.

She said: “The link between the base rate and providers’ savings rates has detached over the years and some providers didn’t increase rates at all following the last rise in the base rate back in 2018 – others by far smaller margins than you would expect.

“The bottom line is that you can’t depend on your savings provider to pass on any base rate rise in its entirety, or sometimes at all. There is no hard and fast rule and some providers will be better than others.”