James O'Brien 10am - 1pm

11 September 2023, 16:44

Catherine Mann, who is a member of the Bank’s Monetary Policy Committee, said she would rather ‘err on the side of over-tightening’ monetary policy.

A Bank of England policymaker has warned that cutting UK interest rates or keeping them at the current level could risk embedding high inflation into the economy.

Catherine Mann, who is a member of the Bank’s nine-person Monetary Policy Committee (MPC) in charge of deciding interest rates, said she would rather “err on the side of over-tightening” monetary policy.

The economist said in a speech given at the Canadian Association for Business Economics: “To pause or to hold the policy rate lower for longer risks inflation becoming more deeply embedded, which would then require more tightening in total, to both change inflation itself and to wring-out the embedded inflation that comes from the sustained duration above target.

“This is why I would rather err on the side of over-tightening.”

She went on: “But, if I am wrong, and inflation decelerates more quickly and activity deteriorates more significantly, I will not hesitate to cut rates.”

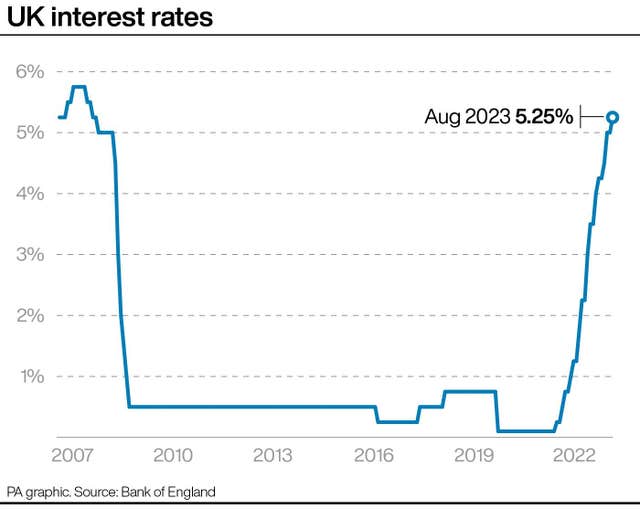

The caution comes before the MPC is due to meet later this month to decide whether or not to lift interest rates higher, from the current rate of 5.25%.

Some economists think rates will go up to 5.5% as pressure on the Bank to control inflation remains.

It means it would become more expensive to borrow, primarily affecting mortgage-holders whose fixed-rate deals have come to an end, or those wanting to take out a new loan to buy a home.

Ms Mann has regularly voted to hike interest rates higher than the level her MPC peers have opted for. Last month, she voted to raise the base rate to 5.5%.

“That is because I believe that the MPR forecast, for a long time, has been telling a story fundamentally different from the one that I consider likely,” she said.

“My story has been one of more resilient domestic demand and more persistent price pressures which therefore requires a more restrictive monetary policy stance.”

She said that holding interest rates at the current level could mean it takes longer to bring inflation down to the Bank’s 2% target, meaning that prices will remain elevated.

The Bank should not be guided by the belief that inflation reaching 3% is “close enough” to target, a view becoming popular in some circles, she argued.

UK Consumer Prices Index (CPI) inflation fell to 6.8% in July, down from 7.9% in June, and is expected to fall sharply towards the end of the year.