Iain Dale 7pm - 10pm

22 July 2021, 15:24

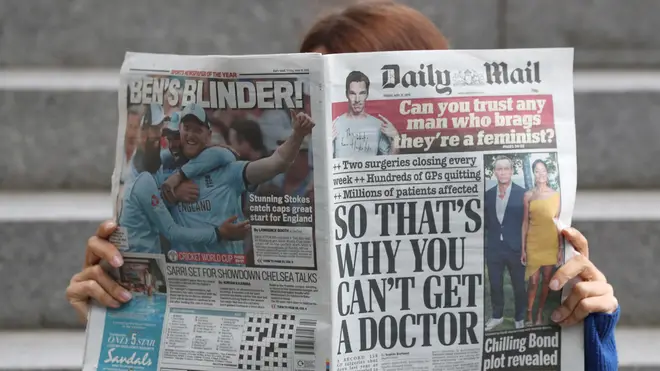

Daily Mail and General Trust (DMGT) updated shareholders on its latest trading performance on Thursday.

The owner of the Daily Mail has reported a sharp jump in revenues for the past quarter, as it awaits a potential bid to be taken private.

Daily Mail and General Trust (DMGT) updated shareholders on its latest trading performance on Thursday, a week after it confirmed that Lord Rothermere was considering a move to take further control of the media firm.

The great-grandson of the newspaper’s founder is eying a move, worth around £810 million, to take the company private for the first time since 1932.

The group, which also owns the Mail on Sunday, Metro and The i newspaper titles, is also in discussions regarding the sale of its insurance division, and a potential special dividend related to its 16% stake in second-hand car platform Cazoo were a transaction to take place.

On Thursday, DMGT hailed “strong year-on-year growth” in the three months to the end of June as it performed in line with market expectations.

It revealed that group revenue increased by 25%, on an underlying basis, to £278 million for the quarter as it was boosted by growth across its operations.

However, revenues for the nine months of the current financial year are down 3% at £858 million despite the latest improvement.

In the latest quarter, DMGT’s business-to-business information services arm posted 24% growth with a particularly strong improvement in its property information business.

Meanwhile, it reported a 22% increase in consumer media revenues for the three-month period.

It said recently-acquired titles New Scientist and The i both reported “pleasing” revenue growth for the period, while the Daily Mail grew its market share.

Print advertising revenues have recovered compared with a “particularly challenged” quarter in the same period last year, but the market remains “relatively weak”.

DMGT also highlighted that Metro has seen an improvement in its circulation in recent months but remains below pre-pandemic levels.

Shares in the business were flat after early trading.