Vanessa Feltz 3pm - 6pm

12 May 2022, 11:14

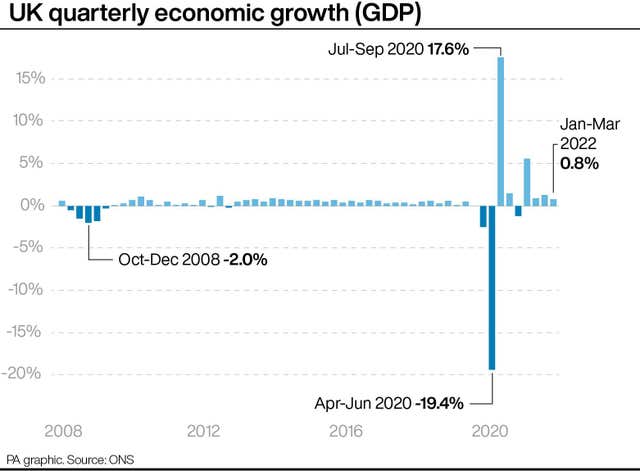

The Office for National Statistics said GDP rose by a weaker-than forecast 0.8% in the first quarter after a 0.1% contraction in March.

Britain’s economy shrank unexpectedly in March as official figures revealed a pullback in consumer spending amid mounting fears that the cost-of-living crisis may plunge the UK into recession.

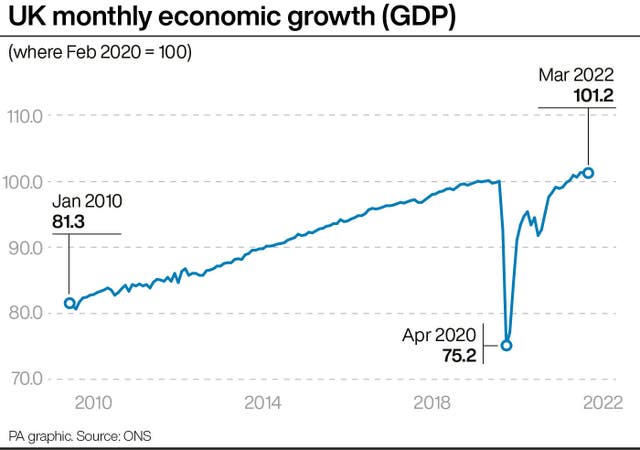

The Office for National Statistics (ONS) said gross domestic product (GDP) fell by 0.1% month on month in March after growth stalled in February – revised down from the 0.1% previous growth estimate.

Experts had expected growth to remain flat in March.

The data shows the impact of soaring inflation on consumer spending, with retail particularly hard hit.

The ONS said the economy grew at its slowest pace for a year in the first quarter overall, with growth of 0.8%, down from 1.3% in the previous three months.

While the expansion means GDP is now 0.7% above levels seen before the pandemic struck, the figures mark the calm before the storm as warnings grow over a recession in the UK due to the cost-of-living crisis.

The National Institute of Economic and Social Research (Niesr) think tank predicted on Wednesday that the UK will fall into recession, forecasting a GDP contraction in the third and fourth quarters.

Calls are growing for an emergency budget to address the cost-of-living crisis, despite the Government having dismissed the need for further urgent action.

Rain Newton-Smith, chief economist at the CBI, said: “The economy barely kept its head above the water during a volatile start to the year, but times look set to get that bit tougher.

“Cost pressures and rising prices have tightened their grip, with both businesses and households feeling the pinch. The end result is a weaker economic outlook.

“It’s clear that the most vulnerable households and energy-intensive businesses may need further support.”

GDP fell 0.1% in March and is now 1.2% above its pre-pandemic level:

▪️ services fell 0.2% (1.5% above)▪️ manufacturing fell 0.2% (1.0% below)▪️ construction grew 1.7% (3.7% above)

➡️ https://t.co/Mqngeuf4cb pic.twitter.com/dHSAxXCOfw

— Office for National Statistics (ONS) (@ONS) May 12, 2022

The Bank of England raised interest rates to a 13-year high of 1% last week to try to curb inflation, and warned that the economy is set to stall in the second quarter, before contracting in the final three months and going into reverse overall in 2023.

While it said the UK is set to avoid a technical recession – defined as two quarters in a row of falling GDP – Governor Andrew Bailey said growth will be “very weak”.

In a grim set of forecasts, the Bank predicted that household incomes will suffer the second biggest decline on record this year, with inflation expected to peak at more than 10% in October.

Chancellor Rishi Sunak said the UK is facing “anxious times”.

“Our recovery is being disrupted by (Vladimir) Putin’s barbaric invasion of Ukraine and other global challenges, but we are continuing to help people where we can,” he told Sky News.

He added that he cannot make global challenges “disappear”.

“What today’s figures show is that, in spite of global inflationary challenges, the UK economy remains resilient,” he said.

“The economy is bigger than it was before coronavirus, and over the last few months we’ve grown faster than America, Germany, France and Italy, for example.”

Total underlying goods imports grew £4.4 bn (9.3%) in March, with both EU and non-EU imports up, though the former might be affected by an HMRC data collection change.

Total underlying goods exports grew £0.6 bn (2.1%) https://t.co/42D1QwS2i5 pic.twitter.com/eC5PRpWdEj

— Office for National Statistics (ONS) (@ONS) May 12, 2022

Figures from the International Monetary Fund have shown that the UK economy is growing faster than many of its peers in the G7, but it also fell further during the pandemic.

Mr Sunak said: “I know these are anxious times, and, unfortunately, because the challenges we face are global in nature, I can’t just make them all disappear.”

The figures showed the declines in March was led by a 0.2% fall in output from the all-important services sector, with consumer-facing services down 1.8% in a sign of the pressure already being felt among households.

Only the construction sector saw expansion in March, thanks in large part to repair work after the February storms, according to the ONS.