Clive Bull 1am - 4am

29 September 2020, 17:24

The FTSE 100 had a lacklustre day closing down 30.43 points, or 0.51%, at 5897.5.

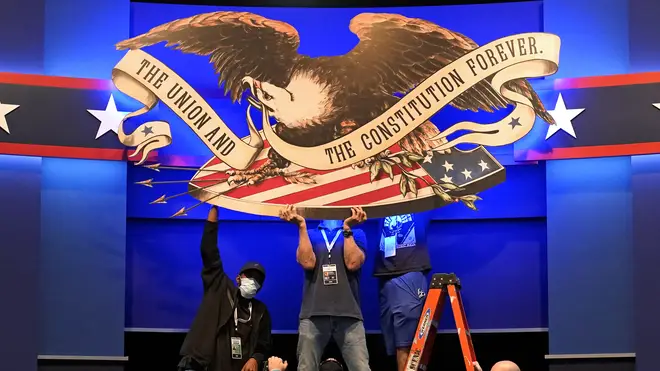

With Covid-19 deaths topping one million and the US presidential debate due to take place late on Tuesday local time, investors preferred to sit on their hands during market hours.

As a result, the FTSE 100 had a lacklustre day closing down 30.43 points, or 0.51%, at 5897.5.

In Europe there were equal amounts of caution with the German Dax and French Cac both closing down 0.35% and 0.23% respectively.

Connor Campbell, financial analyst at SpreadEx, said: “Though it’s not quite clear what the markets are expecting exactly, beyond two socially-distanced old men attempting to slam dunk each other, US investors clearly weren’t interested in doing anything ahead of tonight’s presidential debate.”

Worries that demand is falling also saw Brent crude oil fall 1.6% 41.23 dollars a barrel.

As markets closed the pound was up 0.1% against the dollar at 1.284 and down against the euro 0.4% at 1.096.

In company news Rolls-Royce shares took a dent as Unite the union said its members had been balloted for industrial action over 350 job losses announced in August at the company’s Barnoldswick, Lancashire factory.

Shares closed down 8.85p at 140.4p at a time when the airline industry continues to suffer. British Airways owner, IAG, saw its shares close down 3.4p at 91p.

Greggs announced it could be forced to cut jobs at its stores as it struggles to recover from the Covid-19 restrictions hitting sales at its cafes, in light of the Government’s new Job Support Scheme, which replaces the more-generous furlough in November.

Shares closed down 99p, or 8.1%, at 1,120p.

The news also spooked investors in Upper Crust owner, SSP, which operates in transport hubs alongside some Greggs stores, with shares closing down 19.8p at 185.2p, a fall of 9.7%.

Elsewhere, Heating and plumbing parts giant Ferguson saw shares hit an all-time high after resuming its dividend payouts despite lower annual profits and revenues due to the pandemic.

Share closed up 446p at 7,862p.

Hotel Chocolat reported higher sales for the past year, but said it took a significant hit from the lockdown falling during the key Easter period.

The company said its pre-tax profits slid by 83% to £2.4 million for the year to June 28, compared with the same period last year.

Shares closed down 5p at 345p.

BT shares closed down 2.44p at 97.86p despite the telecoms giant revealed it had signed a major deal with Nokia to roll out 5G mobile phone services for its EE network.

The deal is to replace Huawei ahead of a ban by the Government on the Chinese tech firm.

Discount retailer B&M Bargains said it plans to open up to 45 stores this financial year, as it raised its profit expectations following strong sales during the pandemic.

Shares closed up 19.8p at 510.2p.

The biggest risers on the FTSE 100 were Ferguson up 446p at 7,862p; B&M Bargains up 19.8p at 510.2p; GVC up 38.6p at 1,014p; National Grid up 33.6p at 885p and Smurfit Kappa up 108p at 3,084p.

The biggest fallers were Rolls-Royce down 8.85p at 140.4p; British Land down 14.6p at 331.1p; IAG down 3.4p at 91p; HSBC down 10.05p at 298.5p and Land Securities down 16.5p at 512.4p.