Henry Riley 4am - 7am

23 May 2022, 17:44

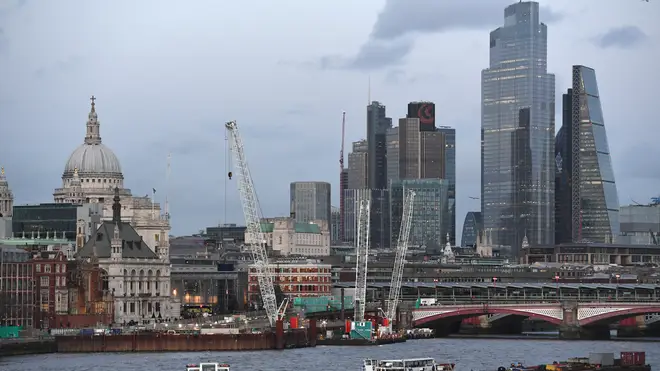

The FTSE 100 index had gained 123.46 points by the end of Monday’s trading.

The top index in London notched up a strong performance on Monday, helped by good sentiment in Europe and the US.

The FTSE 100 was lifted in part by its mining and oil companies while builders also performed well off the back of new house price tracking.

By the end of the day, the index had gained 123.46 points, or 1.7%, ending at 7,513.44.

“The FTSE 100 has continued to stand out as far as European markets are concerned, consolidating its position as a more defensive index,” said CMC Markets analyst Michael Hewson.

He said Germany’s “Dax also got a boost after ECB (European Central Bank) president Christine Lagarde indicated rate rises would start in July, helping to lift the share prices of German and European banks, and help push the euro to its highest level in nearly four weeks against the US dollar”.

The Dax index closed up 1.4% while France’s Cac 40 rose 1.2%. On Wall Street shortly after the European markets had closed, the S&P 500 had gained 1.8% and the Dow Jones was up 2.1%.

“Basic resources are doing well, along with the telecoms sector, with Vodafone posting its second successive day of strong gains after last week’s news that Etisalat had built a stake in the business,” Mr Hewson said.

“Housebuilders have edged higher after the latest Rightmove house price index for May showed a better-than-expected gain on both the monthly and annual measure.”

On currency markets the pound rose 0.01% to 1.2572 dollars and fell 0.01% to 1.1783 euros.

The price of a barrel of Brent crude oil rose 0.6% to 113.17 dollars.

In company news, the owner of B&Q, Kingfisher, said sales fell by 5.8% in the three months to April.

The business said this was still “resilient” and that recent pressure on supply chains have improved.

Although sales might have dropped since last year, they are still considerably ahead of 2019 as the pandemic sparked a DIY boom.

Experts had already predicted a drop in sales and shares were almost at their lowest level in two years last week, Mr Hewson said. Shares rose 2.4% on Monday.

Elsewhere, clothes seller Ted Baker, which is up for sale, has picked a preferred bidder. But it also confirmed that private equity bidder Sycamore is no longer interested.

The chosen suitor will now be allowed to go through its books to make sure everything is in order. Shares dipped 0.9%.

The biggest risers on the FTSE 100 were Royal Mail, up 16.6p to 332p, M&G, up 9.9p to 216.7p, Intermediate Capital Group, up 66p to 1462p, Aviva, up 17.1p to 429.2p, and Vodafone, up 5p to 336.6p.

The biggest fallers on the FTSE 100 were Intertek, down 193p to 4706p, Harbour Energy, down 4.7p to 446.8p, Segro, down 11.5p to 1,105p, Rolls-Royce, down 0.17p to 83.14p, and United Utilities, down 0.5p to 1,129.5p.