Simon Marks 3pm - 7pm

12 March 2024, 11:34

Interest rate increases are really starting to bite for some mortgage borrowers, one commentator said.

The value of outstanding mortgage balances with arrears jumped by just over 50% in the fourth quarter of 2023 compared with a year earlier, according to Bank of England figures.

The Bank said the value of outstanding mortgage balances with arrears increased by 9.2% from the previous quarter, to reach £20.3 billion, which was 50.3% higher than in 2022.

The proportion of the total loan balances with arrears, relative to all outstanding mortgage balances, increased on the quarter from 1.12% to 1.23%, marking the highest proportion recorded since the fourth quarter of 2016.

However, new cases of people falling behind with their house repayments decreased compared with the previous quarter, according to the Bank’s mortgage lenders and administrators statistics.

The value of new mortgage commitments (loans agreed to be handed out in the coming months) decreased by 6.6% from the previous quarter to £46.0 billion, and was 21.2% lower than a year earlier.

If the onset of the Covid-19 pandemic is excluded, this was the lowest level observed since the first quarter of 2013, the Bank said.

Karen Noye, a mortgage expert at wealth manager Quilter, said the figures “paint a very worrying picture of the mortgage market”.

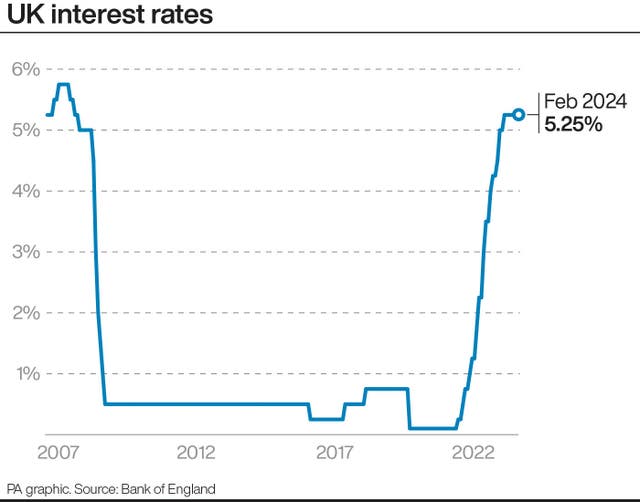

She said of the jump in arrears: “This shows that the large increase in mortgage rates seen over the last couple of years is really starting to bite for some borrowers and this is unfortunately causing them to fall into arrears as they simply can’t afford to keep up with their increased payments.”

Ms Noye added: “For those worried about falling into arrears, it is important to contact your lender as soon as possible as there are options that can help ease the pain, such as going onto a cheaper interest-only mortgage or setting up a payment plan.

“Discussing the problem and not burying your head in the sand is crucial though.”

She continued: “Elsewhere, the data points to a market in a deep freeze similarly suffering from the higher rates. While house prices have remained resilient, the value of new mortgage commitments decreased by 6.6% from the previous quarter to £46.0 billion, and was 21.2% lower than a year earlier.

“This illustrates a serious lack of demand and, although prices continue to be buoyant, if this dearth in demand continues prices may return to a downward trajectory.”

Simon Gammon, managing partner at Knight Frank Finance, said: “At 1.23%, the proportion of loan balances in arrears is still very low, but the pace at which it is rising will be a source of concern for policymakers at the Bank of England.

“The housing market has shown remarkable resilience given the surge in borrowing costs that we’ve seen. Much of that is down to forbearance from lenders, which has kept forced selling very low.

“While borrowing costs have likely peaked and should begin falling meaningfully over the summer, the figures demonstrate that we’re not yet out of the woods and conditions remain very difficult for many borrowers.

“Anybody concerned about not meeting their payments should contact their lender at the earliest opportunity. They can offer solutions like switching to interest only payments, or extending the term of a mortgage, to help borrowers through a difficult period.”

The figures were released as financial information website Moneyfacts said that the average shelf-life of a mortgage product had plummeted to 15 days by the start of March.

The typical length of time for a mortgage product to remain on the market nearly halved in the space of a month, from an average of 28 days at the start of February.

Rachel Springall, a finance expert at Moneyfacts, said: “Mortgage product availability was volatile during February as the average shelf life of a deal plummeted to just 15 days, a six-month low.

“Lenders reacted to the change in swap rates, leading to numerous repricing of fixed-rate deals, no doubt making it a challenging situation for borrowers and brokers to keep on top of the changes.

“The rate volatility led to a rise in both the overall average two- and five-year fixed rates, the opposite direction borrowers may well have hoped for, after positive rate cuts recorded a month prior.

“However, it is worth noting that fixed rates remain lower than at the start of 2024 and there are still some decent options available for borrowers to compare.”