Clive Bull 1am - 4am

11 April 2022, 12:54

Labour has continued to press for answers on Mr Sunak’s arrangements and his wife’s business interests.

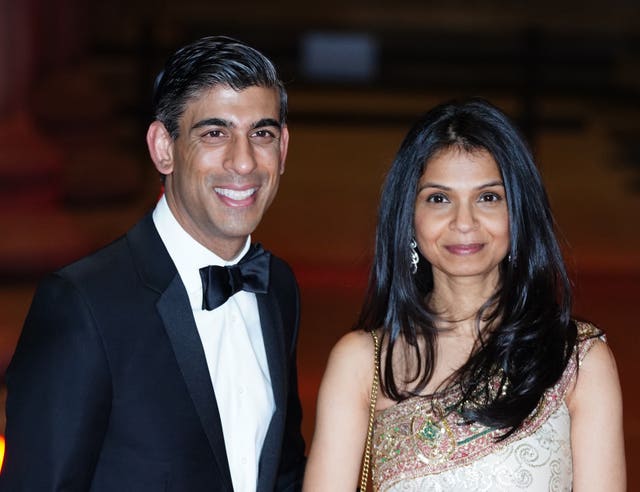

Rishi Sunak has faced continued criticism over his tax arrangements and business affairs despite his wife, Akshata Murty, announcing that she will now pay foreign taxes on her UK income.

In a bid to fend off questions over his family’s finances, the Chancellor referred himself to Boris Johnson’s independent adviser on ministerial interests.

– What are the latest developments in Rishi Sunak’s tax row?

Rishi Sunak’s wife announced that she would pay UK taxes on her global income, claiming in a statement that she did not want the issue “to be a distraction for my husband”.

The Independent first revealed Ms Murty had non-dom status, which typically applies to someone who was born overseas and spends much of their time in the UK but still considers another country to be their permanent residence or “domicile”.

The U-turn came on Friday, just hours after Mr Sunak admitted that he continued to hold a United States green card – granting him permanent residency in the US – for a period while he was Chancellor.

There were also further questions after the Independent reported that Mr Sunak was listed as the beneficiary of trusts set up in the British Virgin Islands and Cayman Islands to help manage the tax and business affairs of Ms Murty’s family interests.

As Labour continued to press for answers on Mr Sunak’s arrangements and his wife’s business interests, on Sunday, the Chancellor wrote to the Prime Minister to ask for an investigation into his own affairs.

An internal inquiry by the Treasury and Cabinet Office into how Ms Murty’s “non-dom” status was leaked to the Independent newspaper is already under way.

– What do we know about the investigation into Rishi Sunak’s financial affairs?

In a letter to the Prime Minister on Sunday, Mr Sunak asked that Lord Geidt, Boris Johnson’s independent adviser on ministerial interests, should review all his declarations of interest since he first became a minister in 2018 to ensure they had been properly stated.

He said he was confident he had acted appropriately at all times but his “overriding concern” was that the public should have confidence in the answers.

Labour’s deputy leader Angela Rayner also wrote to Mr Johnson and Lord Geidt with a detailed series of questions, including whether Mr Sunak had ever benefited from the use of tax havens, whether he made a legal promise to the US when he received his green card that it was his permanent residence, and, if so, whether he was legally a permanent US resident when he entered Parliament and became a minister.

– What do we know about the inquiry into who leaked Akshata Murty’s tax status?

A Whitehall investigation is already under way and is looking into how the information about Ms Murty’s taxes was first passed on to the Independent newspaper.

Speculation at Westminster has suggested a Labour-sympathising civil servant or rivals in No 10 could have been behind the leaking of the confidential information.

Tensions between No 10 and the Chancellor have increased after the spring statement was criticised for not doing enough to help address the cost-of-living crisis.

The Prime Minister denied that No 10 was responsible for hostile briefing against Mr Sunak when he appeared at a joint press conference with German Chancellor Olaf Scholz on Friday.

– Why did the Chancellor hold a US green card?

A spokeswoman for Mr Sunak released a statement on Friday confirming that he held a US green card while Chancellor until seeking guidance ahead of his first US trip in a Government capacity, in October last year.

The US inland revenue says anyone who has a green card is treated as a “lawful permanent resident” and is considered a “US tax resident for US income tax purposes”.

The spokeswoman said Mr Sunak continued to file US tax returns, “but specifically as a non-resident, in full compliance with the law”, having obtained a green card when he lived and worked in the States.

At a Downing Street press conference, Boris Johnson said he was unaware of Mr Sunak holding a US green card, but stressed that the Chancellor had “done absolutely everything he was required to do”.

– Was Rishi Sunak listed in a tax haven as a trust beneficiary while Chancellor?

The Independent reported on Friday that Mr Sunak was listed as the beneficiary of trusts set up in the British Virgin Islands and Cayman Islands to help manage the tax and business affairs of Ms Murty’s family interests.

In response, a spokeswoman close to the Sunak family said: “No-one in Akshata’s family is aware of this alleged trust.”

– Is Rishi Sunak’s political career at risk of being derailed by the tax row?

The row has erupted at a time when Mr Sunak was already under pressure amid criticism that his spring statement last month did little to help low income families struggling with the spiralling cost of living.

Mr Sunak’s net favourability was down 24 points since just before his spring statement on March 23, to reach minus 29, a survey by YouGov found.

Facing questions from broadcasters on Monday, Environment Secretary George Eustice rejected suggestions that Mr Sunak was “too rich” to be Chancellor or a potential prime minister.

But Labour is continuing to press for answers.

It has been estimated Ms Murty’s non-dom status could have saved her £20 million in taxes on dividends from her shares in Infosys, an Indian IT company founded by her father.

Public records show Infosys has received more than £50 million in UK public sector contracts since 2015 – with Labour arguing Mr Sunak should have registered an interest in the firm because of his wife’s involvement.

Shadow justice secretary Steve Reed told the Today programme he “absolutely” believed Mr Sunak had broken the ministerial code as “there’s a whole list of areas where the Chancellor appears to have failed to declare things he should have declared”.

– What does the ministerial code say?

The ministerial code says outside interests must be reported to the Permanent Secretary of their department. It is understood Mr Sunak did report his wife’s status to the Cabinet Office and the Treasury was also aware.

The ministerial code says the register of interests “should also cover interests of the minister’s spouse or partner and close family which might be thought to give rise to a conflict”.